Press releases

Full-Year 2018 Results

Corporate & other activities, Finance

Paris, March 13, 2019

Rise in Group recurring EBIT(1): up 2.1%(2) to €401 million

Free cash flow generation up sharply, at €471 million

Proposed ordinary dividend stable at €1.30 per share

Roll-out of the strategic refocusing continues apace

2019 Group recurring EBIT growth target(1) based on the target scope(3) of between 4% and 6%(4)

The Lagardère group recorded solid revenue growth in 2018 propelled by good momentum at Lagardère Travel Retail.

The Group also delivered a further increase in operating results during the year, fuelled by growth at Lagardère Travel Retail and a good performance from Lagardère Sports and Entertainment. In an environment shaped by the absence of curriculum reform, the contraction at Lagardère Publishing was however contained thanks to a dynamic performance in General Literature.

Free cash flow was significantly up to €471 million, lifted by the business performance and to a lesser extent by property disposals. Excluding property disposals, free cash flow amounted to €288 million (versus €158 million in 2017), up sharply at Lagardère Publishing and Lagardère Travel Retail.

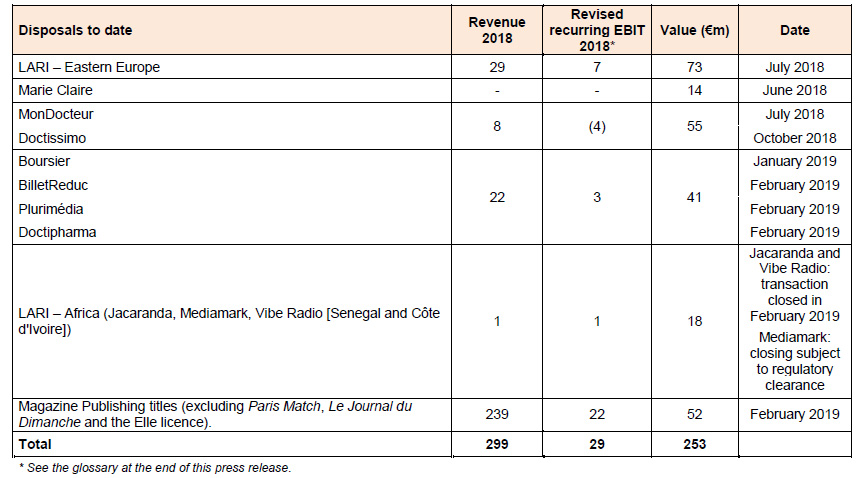

The Group is actively pressing ahead with the roll-out of the strategy to refocus its operations around Lagardère Publishing and Lagardère Travel Retail, with the completion of disposals at Lagardère Active and acquisitions at Lagardère Publishing and Lagardère Travel Retail.

In that context, Lagardère has completed twelve disposals since mid-2018, of the non-French radio operations, the main digital assets (including e-Health), the interest in Marie Claire and most of the magazine publishing titles in France.

The Group also entered into exclusive negotiations for the sale of the TV Channels (excluding Mezzo) in January 2019.

As previously announced, the Group has also made a series of investments in Lagardère Publishing and Lagardère Travel Retail, including the acquisition of Hojeij Branded Foods, a leading Foodservice operator in North America (November 2018), and the Worthy Publishing Group (September 2018), as well as entering into exclusive negotiations for the purchase of Gigamic, a creator, publisher and distributor of board games (January 2019).

These acquisitions were wholly financed out of proceeds from the divestment of non-core assets (Lagardère Active businesses and property assets).

Continued growth momentum

- The Lagardère group reported revenue of €7,258 million in 2018, up 3.3% like-for-like(1). This growth momentum was powered by a solid performance at Lagardère Travel Retail, which delivered 8.8% growth, partially offset by lacklustre business cycles at Lagardère Publishing and Lagardère Sports and Entertainment.

Continued rise in Group recurring EBIT

- With Group recurring EBIT growth of 2.1%(2) versus 2017, Lagardère successfully delivered on its guidance as revised upwards on 26 July 2018 (“growth between 1% and 3% versus 2017, at constant exchange rates, excluding the impact of disposals at Lagardère Active and the acquisition of HBF by Lagardère Travel Retail”).

- Group recurring EBIT came in at €401 million versus €399 million in 2017, powered by good performances from Lagardère Travel Retail and Lagardère Sports and Entertainment.

- Profit before finance costs and tax was higher at €409 million in 2018 compared to €275 million in 2017 due chiefly to disposal gains.

- Profit – Group share made good gains, up to €194 million from €176 million in 2017.

Solid financial position

At end-December 2018, net debt remained stable at €1,375 million. The leverage ratio (net debt(1)/recurring EBITDA(1)) at end-2018 was down slightly year on year at 2.1.

I- REVENUE AND RECURRING EBIT(5)

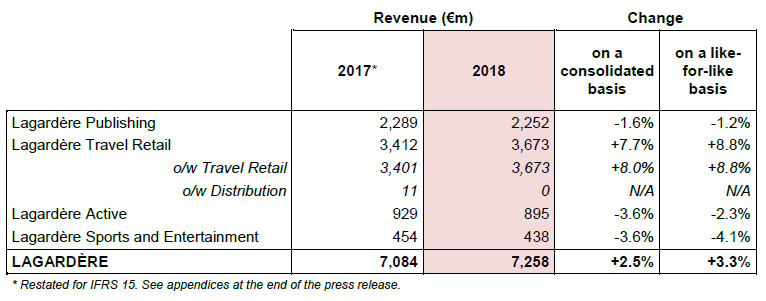

REVENUE

Revenue totalled €7,258 million, up 2.5% on a consolidated basis and up 3.3% like-for-like. The difference between consolidated and like-for-like revenue is essentially attributable to a negative foreign exchange effect resulting mainly from the depreciation of the US dollar. Changes in the scope of consolidation had a positive impact on revenue, due chiefly to acquisitions at Lagardère Publishing and Lagardère Travel Retail, partially offset by the divestment of LARI, Doctissimo and MonDocteur by Lagardère Active.

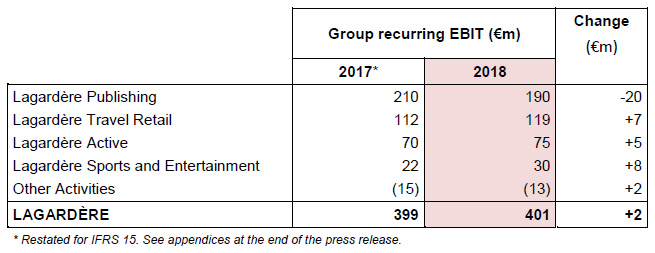

GROUP RECURRING EBIT

Group recurring EBIT came in at €401 million, an increase of €2 million on the 2017 figure as restated for IFRS 15 (€399 million).

Lagardère Active’s divestment of International Radio operations, MonDocteur and Doctissimo resulted in a €3 million negative scope effect, while Lagardère Travel Retail’s acquisition of HBF had a positive scope impact of €1 million. Changes in exchange rates had a €5 million negative impact on recurring EBIT.

Stripping out these effects, Group recurring EBIT growth was 2.1%, in line with the target announced in fourth-quarter 2018 (“growth between 1% and 3% versus 2017, at constant exchange rates, excluding the impact of disposals at Lagardère Active and the acquisition of HBF by Lagardère Travel Retail”).

Lagardère Publishing

Revenue

2018 revenue totalled €2,252 million for the division, down 1.6% based on consolidated figures and down 1.2% like-for-like.

As expected, the slight decline in business in 2018 essentially reflects the 13.4% (€49 million) contraction in Education amid the absence of curriculum reform in France, Spain and the United Kingdom, partly countered by the success of General Literature, up 2.2%, or €22 million.

France was down by 3.8% and Spain/Latin America by 5.1% on account of the aforementioned decline in Education, as well as an unfavourable comparison effect in Illustrated Books linked to the success of Astérix et la Transitalique in 2017 in these regions.

The United States advanced by 3.7%, driven by the success of best-selling titles (including the Bill Clinton and James Patterson novel The President is Missing and Nicholas Sparks’ Every Breath), good performances at Perseus and a dynamic showing from audio books. The United Kingdom slipped 0.5%, with the downturn in Education partially offset by good momentum in General Literature (including J.K. Rowling’s Fantastic Beasts: The Crimes of Grindelwald, and Michael Wolff’s Fire and Fury). Partworks remained stable (up 0.1%) thanks to a good backlist performance after the success of new title releases in 2017, particularly in Japan.

E-books accounted for 7.9% of total Lagardère Publishing revenue in 2018, with the proportion remaining stable versus 2017, while Digital audio books represented 2.7% of revenue versus 2.0% in 2017.

Recurring EBIT

Lagardère Publishing reported €190 million in recurring EBIT, down €20 million on 2017. This decline chiefly reflects the sharp fall in Education, which has a structurally strong operating margin, and to a lesser extent, the contraction in Illustrated Books in France, which had been buoyed by the publication of Astérix et la Transitalique in 2017. The unfavourable currency effect also had an impact on recurring EBIT.

These factors were only partly countered by good momentum in General Literature, particularly in the United States, and by the contribution of recent acquisitions in the United Kingdom.

Lagardère Travel Retail

Revenue

2018 revenue totalled €3,673 million for the division, a rise of 7.7% based on consolidated figures and of 8.8% like-for-like.

The EMEA region (excluding France) reported bullish momentum (up 9.9%), driven in Switzerland by new Duty Free concessions opened at Geneva airport in October 2017, in Poland by a good performance from Foodservice activities at Warsaw airport as well as network expansion, in Romania by solid organic growth, in Italy where strong revenue growth was driven by the modernisation of the Venice concession and the opening of numerous new stores, including in Palermo, Bologna, Trieste, Genoa, Bari and Rome, and lastly in Senegal by the new concession opened at Dakar airport in December 2017.

France posted 4.0% revenue growth despite the unfavourable impact of industrial action in the second quarter of 2018. Growth was led by Foodservice activities on the back of network expansion and good organic growth momentum, as well as by a solid performance from regional Duty Free platforms.

North America reported solid 4.8% growth, lifted by sales initiatives and robust passenger traffic.

Business surged 22.7% in Asia-Pacific, powered mainly by the opening of the Hong Kong concession in partnership with China Duty Free Group in October 2017 as well as a good performance from fashion stores in China, and by firm trading in the Pacific region, where growth in New Zealand Duty Free outlets offset an unfavourable network impact in Australia.

Recurring EBIT

Recurring EBIT amounted to €119 million in 2018, up €7 million.

This mainly reflects a good organic growth performance from the EMEA region (excluding France), especially in Italy and Poland, as well as a favourable network effect resulting primarily from the new Duty Free concession opened in Geneva. North America also reported a good increase powered by upbeat trading, sales initiatives and revised store concepts.

The division’s operating margin remained stable year on year, at 3.3%, with new business start-up and development costs being offset by margin improvement at existing concessions.

Lagardère Active

Revenue

Revenue for 2018 totalled €895 million, down 3.6% on a consolidated basis and down 2.3% like-for-like.

2018 revenue was down slightly year on year, with a good performance from TV Channels and Audiovisual Production partially countering a drop in advertising and circulation revenues at Magazine Publishing, as well as lower audience figures for the Europe 1 radio station.

The fall in Advertising revenue for the division as a whole was contained over the year at 1.8%, thanks mainly to upbeat trends in advertising revenues from TV channels.

Circulation revenue fell 4.5% for the year as a whole, mainly stemming from a decline in news-stand sales.

Recurring EBIT

Lagardère Active reported €75 million in recurring EBIT, up €5 million on 2017. The operating margin came in at 8.4%, driven mainly by higher advertising revenues from TV activities and by the impact of cost saving initiatives in the Press segment, Radio operations in France and in the corporate functions. These factors more than offset downbeat trends in Press operations, the Europe 1 radio station and certain Digital activities.

Lagardère Sports and Entertainment

Revenue

2018 revenue totalled €438 million for the division, down 3.6% based on consolidated figures and by 4.1% like-for-like.

As expected, 2018 marked the lowest point of the four-year sporting events cycle and the decrease in revenue is primarily linked to an unfavourable calendar effect, with the non-occurrence of the 2017 Total Africa Cup of Nations and the 2017 Asian qualifiers for the 2018 FIFA World Cup. This was partially offset by good performances from the Olympics division and from Football activities in Europe.

Recurring EBIT

Lagardère Sports and Entertainment’s recurring EBIT rose by €8 million to €30 million, with operating margin up 2.2 percentage points year on year to 6.8%.

With 2018 being the lowest point in the four-year sporting events calendar, recurring EBIT growth was driven by the development of the Sponsoring business and by the Olympics division.

Other Activities

Recurring EBIT from Other Activities was a negative €13 million, a slight €2 million improvement on 2017, driven by the continued beneficial effects of the plan to reduce overhead costs.

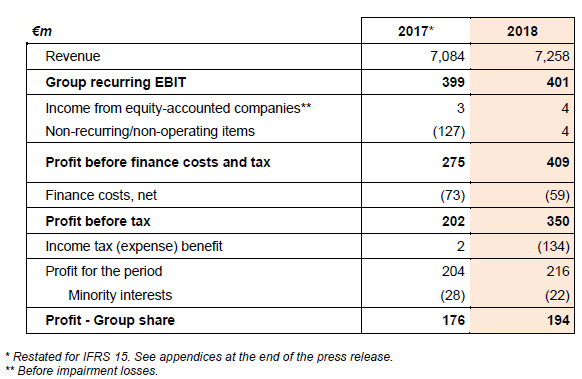

II- MAIN INCOME STATEMENT ITEMS

- Income from equity-accounted companies

Income from equity-accounted companies (before impairment losses) came in at €4 million in 2018, versus €3 million one year earlier, buoyed by good performances from the joint operations at Lagardère Travel Retail.

- Non-recurring/non-operating items

Non-recurring/non-operating items represented a net positive amount of €4 million, compared with a net negative amount of €127 million in 2017, and mainly included:

- €205 million in net disposal gains, reflecting a gain of €245 million on the June 2018 sale of the building located at rue François 1er in Paris and a loss of €40 million on the sale of the 42% interest in Marie Claire;

- €79 million in restructuring costs, including €44 million at Lagardère Active stemming from the reorganisation of the division into standalone units and winding down the corporate function, €21 million at Lagardère Publishing corresponding primarily to the costs of reorganising warehouses in the United Kingdom, €8 million at Lagardère Sports and Entertainment relating to the costs of reorganising activities in Europe, and €6 million at Lagardère Travel Retail;

- €75 million in amortisation of intangible assets and costs relating to the acquisition of consolidated companies, including €59 million for Lagardère Travel Retail, €5 million for Lagardère Publishing, €2 million for Lagardère Active, €7 million for Lagardère Sports and Entertainment and €2 million for Other Activities;

- €47 million in impairment losses on property, plant and equipment and intangible assets, including €40 million at Lagardère Active concerning assets relating to its Press business reclassified in the balance sheet in accordance with IFRS 5 and to Newsweb, LARI and Shopcade, and €2 million at Lagardère Sports and Entertainment relating to the shutdown of operations in Scandinavia. The balance mainly concerns impairment charged against property, plant and equipment, chiefly at Lagardère Travel Retail.

- Finance costs, net

Net finance costs were €59 million in 2018, a decrease of €14 million on 2017, chiefly reflecting a reduction in the Group’s average interest rate between the two periods further to the debt refinancing carried out in 2017.

- Income tax expense

Income tax expense booked in 2018 was €134 million, €136 million more than in 2017. The increase in income tax expense reflects €83 million in tax on the sale of the François 1er building in Paris in 2018. Income tax expense was lower in 2017 due to deferred tax income of €40 million arising on the utilisation of tax loss carryforwards, taking into account the planned sale of this building. 2017 tax expense was also reduced by €19 million in deferred tax income arising on remeasuring the deferred taxes of US subsidiaries following the enactment at 31 December 2017 of the US bill to reduce the federal income tax rate to 21%.

- Profit

Taking account of all these items, profit came out at €216 million, including €194 million attributable to the Group.

Profit attributable to minority interests was €22 million for 2018 versus €28 million in 2017. The year-on-year change chiefly reflects Lagardère Sports and Entertainment’s acquisition of a 10% minority interest in LS Asia in 2018.

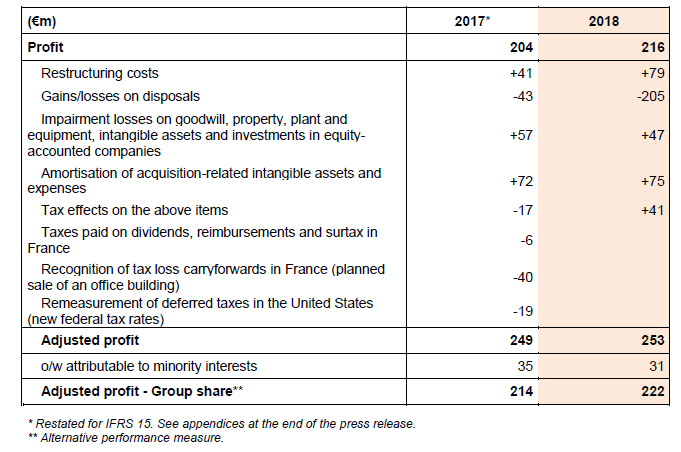

ADJUSTED PROFIT – GROUP SHARE

Adjusted profit – Group share (excluding non-recurring/non-operating items) was €222 million, versus €214 million in 2017.

EARNINGS PER SHARE

Earnings per share – Group share totalled €1.49, versus €1.36 in 2017.

Adjusted earnings per share – Group share was €1.71, versus €1.68 in 2017.

The number of shares comprising the share capital was unchanged from the previous year.

III- OTHER FINANCIAL INFORMATION

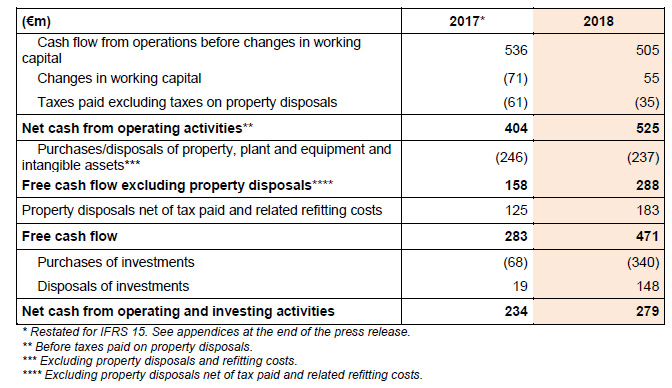

NET CASH FROM OPERATING AND INVESTING ACTIVITIES

- Net cash from operating activities

In 2018, cash flow from operations before changes in working capital amounted to €505 million, compared to €536 million in 2017. The decrease primarily reflects an increase in cash outflows related to restructuring measures (€17 million) as well as a rise in business acquisition and divestment expenses linked to the Group’s strategic refocusing, and a fall in dividends received from equity-accounted companies.

Changes in working capital represented a positive €55 million impact over the year, after a negative €71 million change in 2017. This significant change is partly attributable to an improvement at Lagardère Publishing compared to 2017, which had been affected by a much slower release schedule than in 2016. The improvement in working capital at Lagardère Travel Retail is mainly related to its optimisation efforts, while at Lagardère Sports and Entertainment, the busy calendar of sporting events in 2019 gave rise to inflows in 2018 of amounts due in respect of the African Cup of Nations and the Asian Cup. It should be noted that Lagardère Active’s exit from the receivables securitisation programme relating to the divested Press business reduced working capital by €22 million in 2018.

Income taxes paid (excluding property disposals) totalled €35 million in 2018 compared to €61 million in 2017. The decrease in this item in 2018 is primarily attributable to lower tax payments, notably by Lagardère Publishing in Spain and in Japan owing to lower taxable earnings in 2017 than in 2016.

Taxes paid on property disposals amounted to €42 million in 2018, versus €28 million in 2017.

- Purchases of property, plant and equipment and intangible assets

Net purchases of property, plant and equipment and intangible assets represented an outflow of €237 million, versus €246 million in 2017. Purchases chiefly relate to Lagardère Travel Retail (€130 million), with a significant portion corresponding to the opening of new stores. The balance results essentially from the purchase of sports rights at Lagardère Sports and Entertainment, and logistics projects in the United Kingdom at Lagardère Publishing.

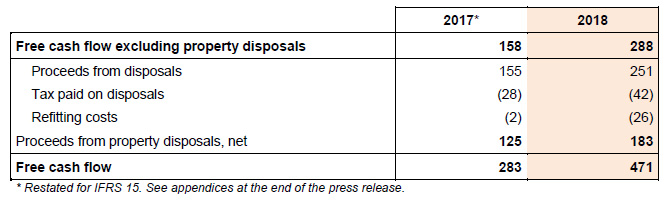

- Free cash flow excluding property disposals

Excluding property disposals, free cash flow totalled €288 million in 2018, up sharply on 2017 (€158 million). This increase is a result of the aforedescribed improvement in working capital.

- Free cash flow

The Group’s free cash flow totalled €471 million in 2018 (versus €283 million in 2017). In 2018, this item includes €183 million in proceeds from the disposal of the rue François 1er building at Lagardère Active (net of taxes and the costs of fitting out new premises), versus €125 million in 2017 in connection with the disposal of properties in Levallois.

- Purchases of investments

Purchases of investments represented an outflow of €340 million and mainly related to Lagardère Travel Retail’s November 2018 acquisition of Hojeij Branded Foods (HBF), a leading Foodservice operator in North America. Purchases also include Lagardère Publishing’s acquisition of Worthy Publishing Group, a publishing house in the United States, and Lagardère Active’s acquisition of a majority stake in Skyhigh TV, the Netherlands’ leading independent production company.

Disposals of investments represented an inflow of €148 million in 2018 (of which €5 million in interest received), including €142 million at Lagardère Active owing to the sale of international radio operations, MonDocteur and Doctissimo, along with the sale of the 42% interest in Marie Claire.

- Total cash flows from operating and investing activities

In all, operating and investing activities represented a net cash inflow of €279 million, versus €234 million in 2017.

FINANCIAL POSITION

At end-December 2018, net debt remained stable at €1,375 million compared to €1,368 million at end-2017, with acquisitions wholly financed out of proceeds from the disposals made during the year (international radio operations, MonDocteur, Doctissimo, the interest in Marie Claire and the rue François 1er building).

– The Group’s liquidity position remains very solid, with €1,960 million in available liquidity (available cash and short-term investments reported on the balance sheet totalling €710 million and an undrawn amount on the syndicated credit line of €1,250 million).

– The Group continues to enjoy a healthy financial position, with a leverage ratio (net debt(1)/recurring EBITDA(1)) of 2.1.

IV- KEY EVENTS SINCE 7 FEBRUARY 2019

- Finalisation of the sale of most of the magazine publishing titles in France to Czech Media Invest (CMI).

The amount of the transaction was €52 million. In connection with the sale, CMI was granted an exclusive license for the Elle brand covering France. The Lagardère group remains the owner of the Elle brand in France and abroad. - Disposal of the interest in the Jacaranda radio station and signing of an agreement for the sale of the Mediamark advertising sales brokerage to South African group Kagiso Media.

The sale price for the interest in Jacaranda was ZAR 233 million or €15 million (based on the exchange rate at 11 February), and that of Mediamark (the closing of which is subject to clearance from the South African competition authorities) is estimated at ZAR 30 million or €2 million (based on the exchange rate at 11 February). - Finalisation of the sale of Plurimedia to Media Press Group.

- Finalisation of the sale of Billetreduc.com to the Fnac Darty group.

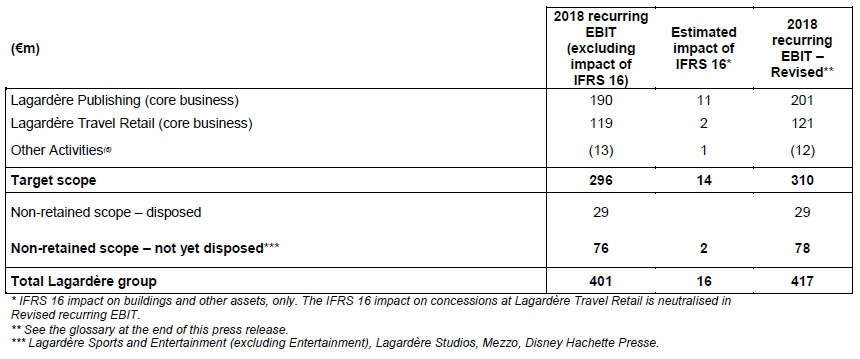

V- STRATEGIC REFOCUSING

Announced during the 2017 annual results presentation on 8 March 2018 and at the General Meeting of 3 May 2018, the Group’s strategic refocusing is based on two priority areas: Lagardère Publishing and Lagardère Retail, ensuring that each is provided with the requisite resources to dominate its respective sector. The objectives are mainly to improve the Group’s industrial profile and cash generation, enabling it in particular to fund the growth of its businesses.

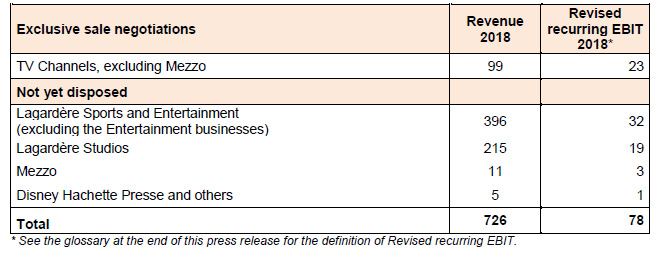

As illustrated in the following table, in implementing this strategy, the Group has identified:

– A target scope, comprising Lagardère Publishing and Lagardère Travel Retail (core businesses), as well as Other Activities (6).

– A non-retained scope, as set out in the appendix to this press release.

VI- OUTLOOK/DIVIDEND

2019 GROUP RECURRING EBIT GROWTH TARGET BASED ON TARGET SCOPE

The Lagardère group expects 2019 recurring EBIT(7) growth based on the target scope(8) to be between 4% and 6% at constant exchange rates and excluding the acquisition of HBF.

NON-RETAINED BUSINESS SCOPE(9)

Based on constant exchange rates, the contribution to recurring EBIT in 2019 for businesses not disposed to date (which represented €78 million in 2018) is expected to be between €80 million and €90 million on a full-year basis.

DIVIDEND

As for 2017, shareholders at the Annual General Meeting will be asked to approve a €1.30 per share dividend for the 2018 fiscal year.

VII- CALENDAR

- Supervisory Board Meeting

The Supervisory Board meeting was held on 13 March 2019 to review the parent company and consolidated financial statements for 2018. - General Meeting – Fiscal year 2018

The General Meeting of Shareholders will be held on 10 May 2019 at 10:00 a.m. at the Carrousel du Louvre in Paris. - Ordinary dividend

The ex-dividend date for the ordinary dividend (proposed at €1.30 per share) for 2018 is expected be 14 May 2019, with a payment date for 16 May 2019. - First-quarter 2019 revenue

Quarterly revenue will be released on 16 May 2019 at 8:00 a.m. A conference call will be held at 10:00 a.m. - First-half 2019 results

The first-half results will be released on 25 July 2019 at 5:35 p.m. A conference call will be held at 6:00 p.m. - Third-quarter 2019 revenue

Quarterly revenue will be released on 14 November 2019 at 8:00 a.m. A conference call will be held at 10:00 a.m.

VIII- APPENDICES

CHANGES IN SCOPE OF CONSOLIDATION AND EXCHANGE RATES

Full-year 2018:

- The difference between consolidated and like-for-like revenue data is attributable to a €110 million negative foreign exchange effect resulting chiefly from fluctuations in the US and Australian dollars, and to a €52 million positive scope effect, breaking down as:

- €30 million positive impact resulting from the acquisitions of Jessica Kingsley, Summersdale, Kyle Cathie, Worthy Publishing and Bookouture at Lagardère Publishing;

- €25 million positive impact relating to Lagardère Travel Retail, including a €40 million positive impact from acquisitions (mainly HBF and to a lesser extent, Duty Free operations in Poland and Travel Essentials activities in the Czech Republic) and a €15 million negative impact from deconsolidations (mainly the divestment of Press Distribution operations in Hungary);

- €13 million negative impact relating to Lagardère Active, relating mainly to the disposal of LARI, MonDocteur and Doctissimo, partly offset by the acquisitions of Skyhigh TV and Aito Media Group;

- €10 million positive impact relating to Lagardère Sports and Entertainment owing chiefly to the acquisition of Brave Marketing IG in October 2017, which was consolidated over full-year 2018.

OPERATIONS DISPOSED OR IN EXCLUSIVE SALE NEGOTIATIONS

(1) Alternative performance measures. See the glossary at the end of this press release.

(2) At constant exchange rates, restated for IFRS 15, excluding the impact of disposals at Lagardère Active and of the acquisition of HBF by Lagardère Travel Retail.

(3) Lagardère Publishing and Lagardère Travel Retail (core businesses), as well as Other Activities including Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM and the Elle licence), the Entertainment businesses, the Group Corporate function, and the Lagardère Active Corporate function whose costs will be wound down by 2020.

(4) Restated for the impact of IFRS 16 on concession contracts at Lagardère Travel Retail, at constant exchange rates and excluding Lagardère Travel Retail’s acquisition of HBF.

(5) The Group’s consolidated financial statements have been audited. The audit report will be signed off once the specific verifications have been completed.

(6) Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM and the Elle licence), the Entertainment businesses, the Group Corporate function, and the Lagardère Active Corporate function whose costs will be wound down by 2020.

(7) See definition at the end of the press release (restated for the impact of IFRS 16 on concession agreements at Lagardère Travel Retail).

(8) Lagardère Publishing and Lagardère Travel Retail (core businesses), as well as Other Activities including Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1, Virgin Radio, RFM and the Elle licence), the Entertainment businesses, the Group Corporate function and, the Lagardère Active Corporate function whose costs will be wound down by 2020.

(9) Recurring EBIT of operations disposed to date is minimal, since the Press business was deconsolidated with effect from 1 January 2019 and the amounts corresponding to the other assets are not significant.

IX- GLOSSARY

Lagardère uses alternative performance measures which serve as key indicators of the Group’s operating and financial performance. These indicators are tracked by the Executive Committee in order to assess performance and manage the business, as well as by investors in order to monitor the Group’s operating performance, along with the financial metrics defined by the IASB. These indicators are calculated based on accounting items taken from the consolidated financial statements prepared under IFRS and a reconciliation with those items is provided in this press release, in the 2018 annual results presentation, or in the notes to the consolidated financial statements.

➢ Like-for-like revenue

Like-for-like revenue is used by the Group to analyse revenue trends excluding the impact of changes in the scope of consolidation and in exchange rates.

The like-for-like change in revenue is calculated by comparing:

– revenue for the period adjusted for companies consolidated for the first time during the period and revenue for the prior-year period adjusted for consolidated companies divested during the period;

– revenue for the prior-year period and revenue for the current period adjusted based on the exchange rates applicable in the prior-year period.

The scope of consolidation comprises all fully-consolidated entities. Additions to the scope of consolidation correspond to business combinations (acquired investments and businesses), and deconsolidations correspond to entities over which the Group has relinquished control (full or partial disposals of investments and businesses, such that the entities concerned are no longer included in the Group’s financial statements using the full consolidation method).

The difference between consolidated and like-for-like figures is explained in section VIII – Appendices of this press release.

➢ Recurring EBIT (Group recurring EBIT)

The Group’s main performance indicator is recurring operating profit of fully consolidated companies (Group recurring EBIT), which is calculated as follows:

Profit before finance costs and tax

Excluding:

• Income from equity-accounted companies before impairment losses

• Gains (losses) on disposals of assets

• Impairment losses on goodwill, property, plant and equipment, intangible assets and investments in equity-accounted companies

• Net restructuring costs

• Items related to business combinations:

– Acquisition-related expenses

– Gains and losses resulting from purchase price adjustments and fair value adjustments due to changes in control

– Amortisation of acquisition-related intangible assets

• Specific major disputes unrelated to the Group’s operating performance

The reconciliation between recurring operating profit of fully consolidated companies (Group recurring EBIT) and profit before finance costs and tax is set out in the full-year 2018 results presentation, on slide 18.

➢ Operating margin

Operating margin is calculated by dividing recurring operating profit of fully consolidated companies (Group recurring EBIT) by revenue.

➢ Recurring EBITDA over a rolling 12-month period

Recurring EBITDA is calculated as recurring operating profit of fully consolidated companies (Group recurring EBIT) plus dividends received from equity-accounted companies, less amortisation and depreciation charged against intangible assets and property, plant and equipment.

The reconciliation between recurring EBITDA and recurring operating profit of fully consolidated companies (Group recurring EBIT) is set out in the full-year 2018 results presentation, on slide 44.

➢ Adjusted profit – Group share

Adjusted profit – Group share is calculated on the basis of profit for the period, excluding non-recurring/non-operating items, net of the related tax and of minority interests, as follows:

Profit for the period

Excluding:

• Gains (losses) on disposals of assets

• Impairment losses on goodwill, property, plant and equipment, intangible assets and investments in equity-accounted companies

• Net restructuring costs

• Items related to business combinations:

– Acquisition-related expenses

– Gains and losses resulting from purchase price adjustments and fair value adjustments due to changes in control

– Amortisation of acquisition-related intangible assets

• Specific major disputes unrelated to the Group’s operating performance

• Tax effects of the above items, including the tax on dividends paid in France

• Non-recurring changes in deferred taxes

• Adjusted profit attributable to minority interests: profit attributable to minority interests adjusted for minorities’ share in the above items.

= Adjusted profit – Group share

The reconciliation between profit and adjusted profit – Group share is set out in section II – Main income statement items of this press release.

➢ Free cash flow

Free cash flow is calculated as cash flow from operations plus net cash flow relating to acquisitions and disposals of intangible assets and property, plant and equipment.

The reconciliation between cash flow from operations and free cash flow is set out in section III – Other financial information of this press release.

➢ Net debt

Net debt is calculated as the sum of the following items:

• Short-term investments and cash and cash equivalents

• Financial instruments designated as hedges of debt

• Non-current debt

• Current debt

= Net debt

The reconciliation between balance sheet items and net debt is set out in the full-year 2018 results presentation, on slide 40.

In the context of the first-time application of IFRS 16 – Leases, effective 1 January 2019, the Group has elected to retain its existing alternative performance measures with certain modifications, in particular the neutralisation of pure accounting effects and distortions created by the new standard on the concessions businesses. From 1 January 2019, these indicators will be monitored by the Executive Committee to assess operating performance and manage the business, along with the financial metrics defined by the IASB. These indicators will be calculated based on accounting items taken from the consolidated financial statements prepared under IFRS and a reconciliation with those items will be provided. To prevent any confusion during the transition period between the alternative performance measures before and after the application of IFRS 16, each corresponding definition is preceded with “Revised”. The estimated impacts of the application of IFRS 16 on the 2018 consolidated financial statements are set out in the 2018 annual results presentation, on slides 47 to 49.

➢ “Revised” recurring EBIT (Group recurring EBIT)

The Group’s main performance indicator is recurring operating profit of fully consolidated companies (Group recurring EBIT), which is calculated as follows:

Profit before finance costs and tax

Excluding:

• Income from equity-accounted companies before impairment losses

• Gains (losses) on disposals of assets

• Impairment losses on goodwill, property, plant and equipment, intangible assets and investments in equity-accounted companies

• Net restructuring costs

• Items related to business combinations:

– Acquisition-related expenses

– Gains and losses resulting from purchase price adjustments and fair value adjustments due to changes in control

– Amortisation of acquisition-related intangible assets

• Specific major disputes unrelated to the Group’s operating performance

• Items related to leases (NEW):

o Cancellation of fixed rental expense* on concessions

o Depreciation of right-of-use assets on concessions

o Gains and losses on lease modifications

* Cancellation of fixed rental expense is equal to the repayment of the lease liability, the associated change in working capital and interest paid in the statement of cash flows.

A live webcast of the presentation of the full-year 2018 results will be available today at 6:00 p.m. (CET) on the Group’s website (www.lagardere.com).

The presentation slides will be made available at the start of the webcast.

A replay of the webcast will be available online later in the evening.

Press Contacts

Thierry FUNCK-BRENTANO - tel. +33 1 40 69 16 34 - tfb@lagardere.fr

Ramzi KHIROUN - tel. +33 1 40 69 16 33 - rk@lagardere.fr

Investor Relations Contact

Florence LONIS - tel. +33 1 40 69 18 02 - flonis@lagardere.fr

The Lagardère group is a global leader in content publishing, production, broadcasting and distribution, whose powerful brands leverage its virtual and physical networks to attract and enjoy qualified audiences.

It is structured around four business lines: Books and e-Books; Travel Retail; Press, Audiovisual, Digital and Advertising Sales Brokerage; Sports and Entertainment.

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Important Notice:

Some of the statements contained in this document are not historical facts but rather are statements of future expectations and other forward-looking statements that are based on management's beliefs. These statements reflect such views and assumptions prevailing as of the date of the statements and involve known and unknown risks and uncertainties that could cause future results, performance or future events to differ materially from those expressed or implied in such statements.

Please refer to the most recent Reference Document (Document de référence) filed by Lagardère SCA with the French Autorité des marchés financiers for additional information in relation to such factors, risks and uncertainties.

Lagardère SCA has no intention and is under no obligation to update or review the forward-looking statements referred to above. Consequently Lagardère SCA accepts no liability for any consequences arising from the use of any of the above statements.

Email alert

To receive institutional press releases from the Lagardère group, please complete the following fields:

Register