Press releases

First-Half 2017 results

Corporate & other activities, Finance

Paris, 27 July 2017

Sustained revenue growth, up 5.4% like-for-like.

Confirmation of recurring EBIT growth target (1) for 2017 at between 5% and 8%(2).

• Revenue up 5.4% like-for-like(3) at €3,306 million

• Strong growth in first-half Group recurring EBIT(1) at €136 million, due mainly to a very busy sporting calendar in the period

• Significant improvement in the Group’s operating margin(1), up by 1.2 points at 4.1%

• Profit before finance costs and taxes at €99 million, up from €94 million in first-half 2016

After a solid first-quarter performance, the Lagardère group continued to deliver growth, lifted by good momentum at Travel Retail, brisk activity at Lagardère Publishing and a favourable calendar impact at Lagardère Sports and Entertainment.

• Robust Group activity

– The Group’s revenue came in at €3,306 million in first-half 2017, down 3.6% on a consolidated basis and up 5.4% like-for-like. Travel Retail, which posted a 9.0% like-for-like increase in revenue, continues to drive the Group’s growth, which was also bolstered by a good start to the year at Lagardère Publishing.

• As expected, Group recurring EBIT was lifted by a busy sporting calendar

– Group recurring EBIT came in at €136 million versus €101 million in first-half 2016. This significant increase reflects the positive impact of a busy sporting calendar at Lagardère Sports and Entertainment, bolstered by a higher contribution from Travel Retail and Lagardère Publishing.

– Profit before finance costs and taxes advanced to €99 million from €94 million in first-half 2016.

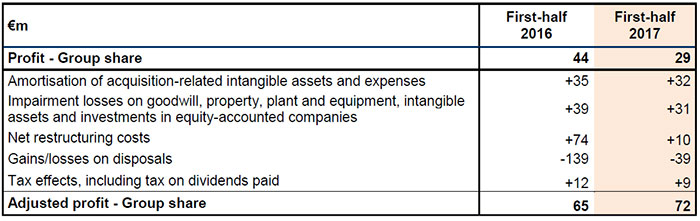

– Profit – Group share was €29 million, down from €44 million in the prior-year period. Adjusted net profit – Group share(1) rose to €72 million from €65 million in the six months to 30 June 2016.

• Solid financial position

– Cash flow from operations before changes in working capital raised +8% compared to first-half 2016, reflecting the good operating performance. Owing to the greater impact of seasonal factors on working capital (typically negative in the first half of the year), free cash flow(1) stood at a negative €67 million, compared to a positive €56 million in first-half 2016.

– Leverage ratio (net debt(1)/recurring EBITDA(1)) improved year-on-year at 2.6x versus 2.8x in first-half 2016, reflecting the Group’s tight rein on debt as well as the impact of recurring EBITDA growth over the period.

I- REVENUE AND RECURRING EBIT

REVENUE

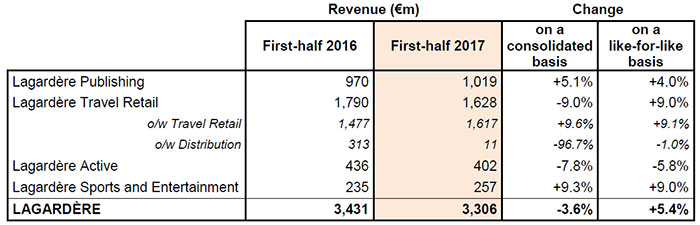

In the first half of 2017, Lagardère group revenue totalled €3,306 million, down 3.6% on a consolidated basis and up 5.4% like-for-like.

The difference between consolidated and like-for-like figures primarily reflects a €301 million negative scope impact. This essentially relates to the divestment of Press Distribution operations by Lagardère Travel Retail (in Spain, Canada and Belgium in 2016, and in Hungary in February 2017), and to the sale of LeGuide.com by

Lagardère Active. These divestments were partly offset by acquisitions carried out by Lagardère Publishing, in particular Perseus in April 2016.

The foreign exchange effect added €8 million to revenue and resulted mainly from gains in the US, Australian and New Zealand dollars and Polish zloty, which countered weakness in the pound sterling.

First-half 2017 revenue:

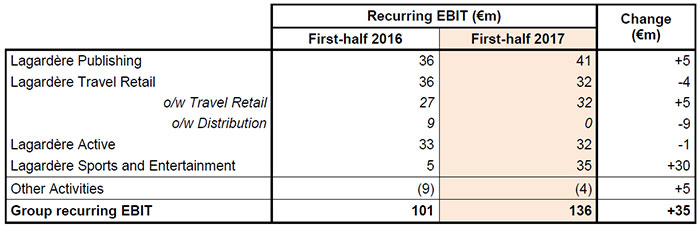

RECURRING EBIT

Lagardère Publishing

Revenue

Revenue came in at €1,019 million, up 5.1% on a consolidated basis and up 4.0% like-for-like. The difference can be explained by a €14 million negative foreign exchange impact due primarily to the depreciation in the pound sterling, offset by a €24 million positive scope impact, essentially related to the consolidation of Perseus.

Activity was up sharply in the first half of 2017, buoyed chiefly by good performances in the United Kingdom and United States.

The figures below are presented on a like-for-like basis.

In France, where the market was affected by the electoral climate, activity retreated 3.1%. The rise in returns was only partially offset by a resilient performance from Literature, which enjoyed success for example with Virginie Despentes’ Vernon Subutex 3 and Laetitia Colombani’s La Tresse.

Activity surged 10.2% in the United Kingdom led by Adult Trade, which saw growth in its frontlist with titles such as John Grisham’s Camino Island and Clare Mackintosh’s I See You, as well as in its backlist. Activity was also lifted by an additional billing week in the period.

The United States performed well, with activity up 5.4% thanks mainly to the Nashville division and to the success of titles such as David Baldacci’s The Fix and James Patterson’s The Black Book.

Activity in the Spain/Mexico region was down 1.1% owing to a one-off export transaction in Latin America in the comparative prior-year period.

The significant 8.0% rise in Partworks was driven by a good performance of the catalogue in Spain and Japan and by the launch of new collections over the period.

The contribution of e-books to Lagardère Publishing’s overall revenue fell to 8.8% in first-half 2017, versus 9.2% in first-half 2016.

Recurring EBIT

Recurring EBIT advanced sharply by €5 million to €41 million. Strong profitability gains in the United Kingdom spurred by the success of the catalogue more than offset the expected decline in France.

Lagardère Travel Retail

Revenue

Revenue for the division totalled €1,628 million (down 9.0% on a consolidated basis and up 9.0% like-for-like), with a €21 million positive foreign exchange effect due mainly to the rise in the US, Australian and New Zealand dollars and Polish zloty. The €316 million negative scope impact essentially related to the divestment of Press Distribution operations in Belgium, Hungary, Spain and Canada.

Network expansion continued apace and Travel Retail activities posted bullish growth, confirming the relevance of the current business strategy.

The figures below are presented on a like-for-like basis.

Travel Retail delivered robust 9.1% growth in first-half 2017 revenue, powered by changes in traffic, ambitious sales initiatives, the launch of new points of sale, the success of innovative concepts and network modernisation.

In France, activity continued to enjoy strong momentum (up 8.1%), lifted by network expansion (particularly in Foodservice) and the success of new concepts (Relay, Aelia Duty Free), as well as a favourable basis for comparison (terrorist attacks in 2016 had led to a weaker prior-year performance). This robust growth was partly countered by the introduction of plain packaging (tobacco revenue down 15%), lower spending by British passengers (owing to Brexit), and stricter passport controls.

The EMEA region (excluding France) reported bullish momentum (up 12.7%), buoyed by the revamped Luton airport concession and upbeat traffic trends in the United Kingdom (up 22.2%), additional sales space and the return of Russian passengers in the Czech Republic (up 19.7%), the increase in passenger traffic and new points of sale opened in Poland (up 18.4%) and the success of new stores in Rome’s airport (Avancorpo terminal) in Italy

(up 13.9%).

Activity was also brisk in North America (up 6.9%) on the back of trade synergies arising on the consolidation of Paradies and network expansion.

Activity was once again mixed in Asia-Pacific (up 4.6%), with continued strong momentum thanks to Fashion concepts and the growth of the Foodservice network in China (up 21.8%), and advances in New Zealand Duty Free operations offsetting the unfavourable network impact in Australia for the Pacific region.

Distribution operations (including Hungary up to end-January only) were down 1.0%. The last of the Group’s Distribution businesses was divested on 7 February 2017.

Recurring EBIT

Recurring EBIT was down €4 million year-on-year, at €32 million from €36 million in first-half 2016.

Travel Retail recurring EBIT was up by €5 million, buoyed by organic revenue growth, especially in Europe and

North America, partly offset by the start-up costs of new operations.

The scope effect was a negative €9 million owing to the divestment of the Distribution business.

Lagardère Active

Revenue

Revenue totalled €402 million, down 7.8% on a consolidated basis and down 5.8% like-for-like. The difference between consolidated and like-for-like revenue is attributable to a negative scope effect of €10 million resulting from the sale of LeGuide.com in September 2016.

The figures below are presented on a like-for-like basis.

Activity was down, hit by a contraction in Press and Radio advertising revenues and by unfavourable programme delivery scheduling for Lagardère Studios.

The 4.2% contraction in Magazine Publishing is related to the 6.3% fall in advertising revenues, despite circulation proving resilient (down 3.4%) thanks chiefly to the electoral climate.

Revenue for the Radio segment retreated 6.8%, as good momentum in music radio failed to offset lower audience figures for the Europe 1 station over the period.

TV activities declined sharply by 8.1% over the period, due primarily to the contraction at Lagardère Studios.

Pure-play digital and B2B revenue slipped 2.7%, with the decline in B2B operations weighing on the good performance of e-health (MonDocteur) and BilletRéduc ticketing services.

Advertising revenue fell 6.2% for the division as a whole.

Recurring EBIT

Recurring EBIT was stable at €32 million. The underperformance of Europe 1, on the back of a decline in its audience figures, was offset by an improvement in the Press business, owing to the cost-cutting measures in place and in Lagardère Studios thanks to a favourable business mix.

Lagardère Sports and Entertainment

Revenue

Revenue rose significantly to €257 million, up 9.3% on a consolidated basis and up 9.0% like-for-like. The difference between reported and like-for-like figures is attributable to a positive scope effect (+ €1 million), mainly due to the acquisition of Rooftop2 Productions.

The sharp increase in activity can be explained by a positive calendar effect related to the good completion of contracts for the Total Africa Cup of Nations held in Gabon and the Asian qualifiers for the 2018 FIFA World Cup. In addition, football activities in Europe (Germany and United Kingdom) performed well and Lagardère Live Entertainment was buoyed notably by the executive production over the period (in particular Phil Collins tour in France).

Recurring EBIT

Recurring EBIT amounted to €35 million versus €5 million in H1 2016. As expected, first-half 2017 was marked by a positive seasonal effect, given a very busy sporting calendar.

• Other Activities

Recurring EBIT from Other Activities was a negative €4 million, a significant improvement on first-half 2016. This mainly reflects the favourable impact resulting from the recovery of VAT (including an adjustment in 2016), along with the first beneficial effects of the plan to reduce overhead costs.

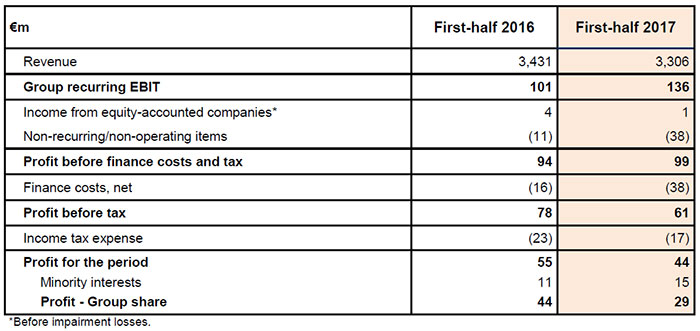

II- MAIN INCOME STATEMENT DATA

NON-RECURRING/NON-OPERATING ITEMS

Non-recurring/non-operating items represented a negative amount of €38 million, and mainly comprised:

– €10 million in restructuring costs, including €6 million for Lagardère Travel Retail corresponding primarily to costs incurred in reorganising the North American business following the acquisition of Paradies in late 2015, and €4 million for Lagardère Active, relating chiefly to the cost of discontinuing the core operations of an audiovisual production company;

– €39 million in net gains on asset disposals, including €40 million in gains on the disposal of an office building in Levallois-Perret (France) in June 2017 (Other Activities);

– €31 million in impairment losses, including €24 million charged against the equity-accounted shares held in the Marie Claire group amid a downturn in the French and international advertising markets, and €7 million charged against property, plant and equipment at Lagardère Travel Retail and Lagardère Active;

– €36 million in amortisation of intangible assets and costs relating to the acquisition of consolidated companies, including €31 million for Lagardère Travel Retail, €3 million for Lagardère Publishing and €2 million for Lagardère Sports and Entertainment.

FINANCE COSTS, NET

Net finance costs amounted to €38 million, a rise of €22 million on the prior-year period which had benefited from gains on the disposal of shares in Deutsche Telekom (€22 million).

INCOME TAX EXPENSE

Income tax expense for first-half 2017 came to €17 million versus €23 million in first-half 2016. This decrease is mainly attributable to a tax base effect resulting from taxes on disposals in 2016, in particular Yen Press in the United States. Income tax expense on property sales was the same in both first-half 2016 and first-half 2017.

PROFIT

Including all these items, profit came out at €44 million, including €29 million attributable to the Group.

ADJUSTED PROFIT – GROUP SHARE

III- OTHER FINANCIAL INFORMATION

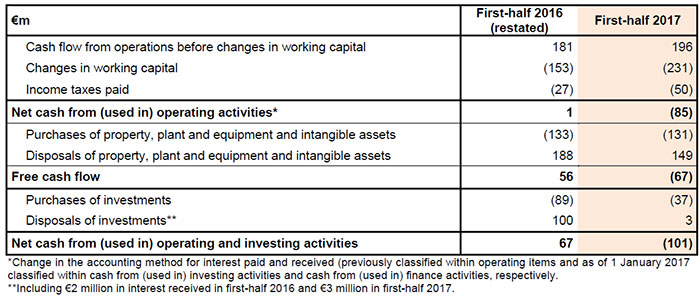

NET CASH FLOW FROM (USED IN) OPERATING AND INVESTING ACTIVITIES

• Net cash from operating activities

– Cash flow from operations before changes in working capital was €196 million, up €15 million on the prior-year period. This reflects the €35 million rise in recurring EBIT, partly offset by an increase in net reversals of provisions and a fall in dividends received from equity-accounted companies, essentially at Lagardère Travel Retail and Lagardère Active.

– Changes in working capital (typically negative in the first half) represented a negative €231 million. The

year-on-year decline is attributable to Lagardère Publishing, with first-half 2017 witnessing a reversal of the bullish trends enjoyed in full-year 2016, a rise in advances paid to authors in the United States (renewal of multi-title contracts) and in France, and the settlement of amounts owed to authors in the United Kingdom (corresponding to royalties earned on successful titles in 2016).

– Income taxes paid totalled €50 million compared to €27 million in first-half 2016. This increase is primarily due to a rise in prepayments made in connection with tax consolidation in France owing to higher taxable earnings in 2016 compared to 2015, and the refund of a tax credit in the United States in early 2016.

• Net purchases of property, plant and equipment and intangible assets

– Purchases of property, plant and equipment and intangible assets remained stable year-on-year, representing an outflow of €131 million, primarily relating to Lagardère Travel Retail in line with its

Travel Retail growth strategy, Lagardère Sports and Entertainment (acquisitions of sports rights) and Lagardère Publishing (namely logistics projects in the United Kingdom and United States).

– Disposals of intangible assets and property, plant and equipment represented cash inflows of €149 million in first-half 2017, essentially relating to the sale of an office building in Levallois-Perret.

• Free cash flow

– Free cash flow was a negative €67 million in first-half 2017 (versus a positive €56 million in the prior-year period), hit mainly by changes in working capital (typically negative in the first half).

• Net cash used in financing activities

– Purchases of investments represented an outflow of €37 million in the six months to 30 June 2017 and mainly related to acquisitions carried out by Lagardère Publishing, in particular Bookouture, an e-book publisher in the United Kingdom, and IsCool Entertainment, a development studio for web and mobile social games. The remaining balance corresponds to smaller-scale acquisitions carried out by Lagardère Travel Retail and Lagardère Active and to a lesser extent, miscellaneous earn-outs paid by Lagardère Sports and Entertainment.

– Disposals of investments, which include interest received, represented an inflow of €3 million in

first-half 2017.

FINANCIAL POSITION

At 30 June 2017, net debt stood at €1,677 million, an increase of €288 million compared to 31 December 2016, due chiefly to the adverse impact of seasonal fluctuations on working capital.

The Group’s liquidity position remains solid, with €2,006 million in available liquidity (available cash and short-term investments reported on the balance sheet totalling €756 million and authorised but undrawn credit facilities for €1,250 million). Cash includes proceeds collected in June 2017 on the €300 million, seven-year bond issue. The average maturity of debt in the repayment schedule will be extended following redemption of the bonds due on 31 October 2017.

IV- GUIDANCE

Lagardère confirms its target for Group recurring EBIT growth announced on 8 March.

Based on our first-half performance in line with forecasts and our outlook for the second half, we can confirm our target on Group recurring EBIT for 2017 as announced in March.

Group recurring EBIT growth in 2017 is expected to be between 5% and 8% versus 2016, at constant exchange rates and excluding the impact from disposals of Distribution activities.

V- HIGHLIGHTS SINCE THE PUBLICATION OF FIRST-QUARTER 2017 REVENUE

IsCool Entertainment

In April 2017, Hachette Livre, a Lagardère Publishing subsidiary, acquired French company IsCool Entertainment, a development studio for web and mobile social games.

Bond issue

On 14 June 2017, Lagardère SCA successfully launched a €300 million, seven-year bond issue, with an annual coupon of 1.625%, for European investors. The proceeds of this issue will be used for general corporate purposes, notably the redemption of the 2012 bond issue due on 31 October 2017.

Disposal of the Europa building

On 28 June 2017, Lagardère sold a 26,500-sq.m. office building in Levallois-Perret (France) to LaSalle Investment Management and Ardian.

VI- INVESTOR CALENDAR

• Announcement of Q3 2017 revenue

Third-quarter revenue will be released on 9 November 2017 at 8:00 a.m. A conference call will be held at 10:00 a.m. on the same day.

VII- APPENDICES

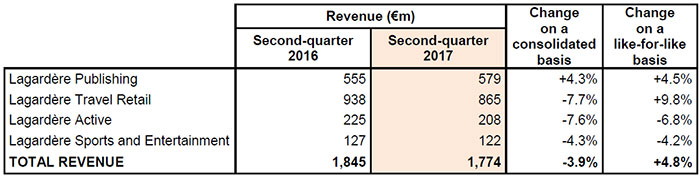

SECOND-QUARTER 2017 REVENUE:

CHANGES IN CONSOLIDATION SCOPE AND EXCHANGE RATES

First-half 2017

The difference between consolidated and like-for-like data reflects an €8 million positive foreign exchange impact relating mainly to the appreciation in the US, Australian and New Zealand dollars, and a €301 million negative scope effect, breaking down as:

• the negative impact of disposals (€331 million), primarily relating to the divestment of Distribution activities in Belgium (negative €216 million), Hungary (negative €59 million), Spain (negative €17 million) and Canada (negative €11 million) by Lagardère Travel Retail, and to the sale of LeGuide.com by Lagardère Active (negative €10 million);

• the positive impact of acquisitions (€30 million), carried out mainly by Lagardère Publishing in connection with the consolidation of Perseus in the United States (€18 million).

VIII- GLOSSARY

Lagardère uses alternative performance indicators which serve as key measures of the Group’s operating and financial performance. These indicators are tracked by the Executive Committee in order to assess performance and manage the business, as well as by investors in order to monitor the Group’s operating performance, along with the financial metrics defined by the IASB. These indicators are calculated based on elements taken from the consolidated financial statements prepared under IFRS and a reconciliation with those accounting items is provided either in this press release or in the notes to the consolidated financial statements.

Like-for-like revenue

Like-for-like revenue is used by the Group to analyse revenue trends excluding the impact of changes in the scope of consolidation and in exchange rates.

The like-for-like change in revenue is calculated by comparing:

– H1 2017 revenue to exclude companies consolidated for the first time during the period, and H1 2016 revenue to exclude companies divested in H1 2017;

– H1 2017 and H1 2016 revenue based on H1 2016 exchange rates.

The scope of consolidation includes companies fully consolidated. Companies consolidated for the first time during the period refer to business combinations (Investments or business acquired), and companies divested refer to loss of control (disposals of investments or business which led to stop the full consolidation).

The difference between consolidated and like-for-like figures is explained in section VII – Appendices of this press release.

Recurring EBIT

The Group’s main performance indicator is recurring operating profit of fully consolidated companies (Group recurring EBIT), which is calculated as follows:

Profit before finance costs and tax

Excluding:

• Gains (losses) on disposals of assets

• Impairment losses on goodwill, property, plant and equipment, intangible assets and investments in

equity-accounted companies

• Net restructuring costs

• Items related to business combinations

– Acquisition-related expenses

– Gains and losses resulting from purchase price adjustments and fair value adjustments due to changes in control

– Amortisation of acquisition-related intangible assets

• Specific material disputes unrelated to the Group’s operating performance

= Recurring operating profit

Less:

• Income (loss) from equity-accounted companies before impairment losses

= Recurring operating profit of fully consolidated companies (Group recurring EBIT)

The reconciliation between recurring operating profit of fully consolidated companies and profit before finance costs and tax is set out in Note 3 to the consolidated financial statements for the six months ended 30 June 2017.

Operating margin

The operating margin is calculated by dividing recurring operating profit of fully consolidated companies (Group recurring EBIT) by revenue.

Recurring EBITDA over a rolling 12-month period

Recurring EBITDA is calculated as recurring operating profit of fully consolidated companies (Group recurring EBIT) plus dividends received from equity-accounted companies, less amortisation and depreciation charged against intangible assets and property, plant and equipment.

The reconciliation between recurring EBITDA and recurring operating profit of fully consolidated companies (Group recurring EBIT) is set out in the presentation of the 2017 interim results.

Adjusted profit – Group share

Adjusted profit – Group share is calculated on the basis of profit – Group share, excluding non-recurring/non-operating items, net of tax and minority interests, as follows:

Profit – Group share

Excluding:

• Gains (losses) on disposals of assets

• Impairment losses on goodwill, property, plant and equipment, intangible assets and investments in

equity-accounted companies

• Net restructuring costs

• Items related to business combinations

– Acquisition-related expenses

– Gains and losses resulting from purchase price adjustments and fair value adjustments due to changes in control

– Amortisation of acquisition-related intangible assets

• Specific material disputes unrelated to the Group’s operating performance

• Tax effects of the above items, including the tax on dividends paid in France

= Adjusted profit – Group share

The reconciliation between profit – Group share and adjusted profit – Group share is set out in section II – Main income statement items.

Free cash flow

Free cash flow is calculating as cash flow from operations plus net cash flow relating to acquisitions and disposals of intangible assets and property, plant and equipment.

The reconciliation between cash flow from operations and free cash flow is set out in Note 3.1 to the consolidated financial statements for the six months ended 30 June 2017.

Net debt

Net debt is calculated as the sum of the following items:

• Short-term investments and cash and cash equivalents

• Financial instruments allocated as hedges of debt

• Non-current debt

• Current debt

= Net debt

The reconciliation between balance sheet items and net debt is set out in Note 15 to the consolidated financial statements for the six months ended 30 June 2017.

(1) Alternative performance indicators. See the glossary at the end of this press release.

(2) Versus 2016, at constant exchange rates and excluding the impact from disposals of Distribution activities.

(3) See the “Changes in consolidation scope and exchange rates” section at the end of the press release.

Press Contacts

Thierry FUNCK-BRENTANO - tel. +33 1 40 69 16 34 - tfb@lagardere.fr

Ramzi KHIROUN - tel. +33 1 40 69 16 33 - rk@lagardere.fr

Florence LONIS - tel. +33 1 40 69 18 02 - flonis@lagardere.fr

The Lagardère group is a global leader in content publishing, production, broadcasting and distribution, whose powerful brands leverage its virtual and physical networks to attract and enjoy qualified audiences.

It is structured around four business lines: Books and e-Books; Travel Retail; Press, Audiovisual, Digital and Advertising Sales Brokerage; Sports and Entertainment.

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Important Notice:

Some of the statements contained in this document are not historical facts but rather are statements of future expectations and other forward-looking statements that are based on management's beliefs. These statements reflect such views and assumptions prevailing as of the date of the statements and involve known and unknown risks and uncertainties that could cause future results, performance or future events to differ materially from those expressed or implied in such statements.

Please refer to the most recent Reference Document (Document de référence) filed by Lagardère SCA with the French Autorité des marchés financiers for additional information in relation to such factors, risks and uncertainties.

Lagardère SCA has no intention and is under no obligation to update or review the forward-looking statements referred to above. Consequently Lagardère SCA accepts no liability for any consequences arising from the use of any of the above statements.

Email alert

To receive institutional press releases from the Lagardère group, please complete the following fields:

Register