Press releases

2016 FIRST HALF RESULTS

Corporate & other activities, Finance

Paris, 28 July 2016

Confirmation of recurring EBIT(1) growth target for 2016 slightly above 10% compared to 2015(2) based on a solid first-half and encouraging outlook for the second half.

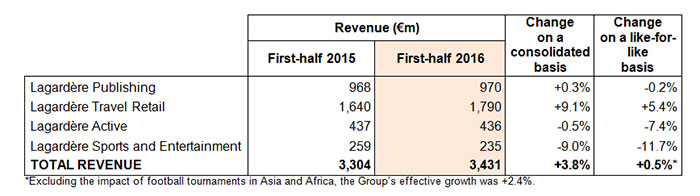

• Revenue totalled €3,431 million, up 3.8% on a consolidated basis and up 0.5% like-for-like(3)

• Group recurring EBIT down as expected in the first six months of the year to €101 million, due to fewer sporting events in first-half 2016.

• Sharp rise in profit – Group share, at €44 million.

• Significant improvement in Free cash flow(4), at €47 million.

The Lagardère group continued to deliver growth in an uncertain environment in first-half 2016, buoyed by good momentum in Travel Retail and a resilient performance from Lagardère Publishing.

• Positive business performance

Lagardère Group revenue came in at €3,431 million in first-half 2016, up 3.8% on a consolidated basis, up 0.5% like-for-like and up 2.4% like-for-like excluding the calendar impact of sporting events. Travel Retail remains a major growth engine, posting an increase of 7.8% like-for-like.

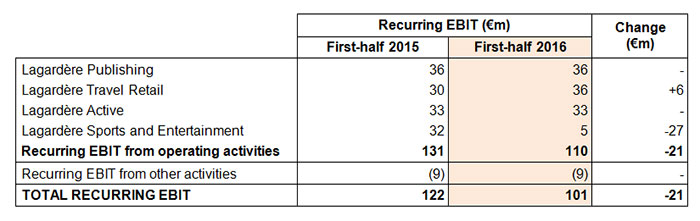

• As expected, Group recurring EBIT was hit by an adverse sporting calendar impact in first-half 2016

Group recurring EBIT (operating divisions and other activities) came in at €101 million versus €122 million in first-half 2015. This reflects the adverse impact of scheduled events for Lagardère Sports and Entertainment, which was partly offset by the sharp increase in the contribution from Travel Retail.

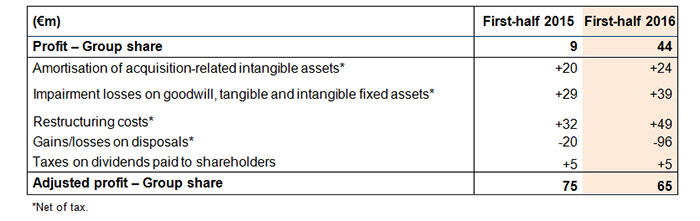

Profit – Group share rose sharply to €44 million from €9 million in first-half 2015, powered by the disposal of a non-operation asset and a fall in interest expense. Adjusted profit – Group share slipped to €65 million from €75 million in the same prior-year period.

• Solid financial position

Although seasonal factors typically have a negative impact in the first six months of the year, Free cash flow totalled €47 million (compared to a negative €84 million in first-half 2015).

Leverage (net debt/recurring EBITDA(4)) improved year-on-year at 2.8x, excluding the acquisition of Paradies, reflecting the Group’s tight rein on debt.

I- REVENUE AND RECURRING EBIT

REVENUE

In the first half of 2016, Lagardère group revenue totalled €3,431 million, up 3.8% on a consolidated basis and up 0.5% like-for-like.

The difference between consolidated and like-for-like data reflects a €42 million negative foreign exchange effect, due notably to the depreciation in the pound sterling (a €17 million negative impact), and a €153 million positive scope impact, essentially relating to Lagardère Travel Retail(5).

First-half 2016 revenue:

RECURRING EBIT OF FULLY CONSOLIDATED COMPANIES

Lagardère Publishing

Revenue

Revenue came in at €970 million, up 0.3% on a consolidated basis and down 0.2% like-for-like. The difference can be explained by a negative foreign exchange effect totalling €18 million, due primarily to the depreciation in the pound sterling, offset by a positive scope impact of €22 million.

Business was stable in the first half of 2016, buoyed chiefly by good momentum in Partworks, Education in Spain and Literature and Distribution in France.

The figures below are presented on a like-for-like basis.

In France, business grew 2.5% on the back of good momentum in General Literature with the commercial success of paperbacks such as Grey by E L James and After by Anna Todd, along with fiction and non-fiction titles including Vous n’aurez pas ma haine by Antoine Leiris, La puissance de la joie by Frédéric Lenoir, Vivez mieux et plus longtemps by Michel Cymes and Simplissime by Jean-François Mallet.

Distribution revenue also grew, thanks mainly to the contribution of third party publishers.

In the United-Kingdom, the 4.7% downturn in revenue results primarily from negative comparison effects with

first-half 2015. E-book revenue was hit by a return to an agency contract model with distributors as of 1 July 2015.

In the United States, the 6.6% decline in activity in terms of both printed and e-book revenue was attributable to a less intensive new release schedule than in first-half 2015 (shaped by an eventful film season based around The Longest Ride by Nicholas Sparks and three new releases from James Patterson). However, Distribution activities for third party publishers performed well.

The Spain/Latin America region posted a strong 11.9% rise in revenue, with early orders for textbooks in Spain and a one-off export transaction in Latin America.

Partworks enjoyed robust 9% growth, attributable to the success of works launched in 2015 and early 2016, particularly in Japan, the UK and Italy.

E-books accounted for 9.2% of total Lagardère Publishing revenue in first-half 2016, compared to 10.7% in first-half 2015.

Recurring EBIT

Lagardère Publishing reported +€36 million in recurring EBIT, stable compared to the first six months of 2015. During the period, strong profitability gains in the US attributable to disciplined cost management, and robust earnings from Partworks, offset the decline in e-book revenue in the UK and the impact of costs associated with curricular reform in France.

Lagardère Travel Retail

Revenue

Revenue for the division totalled €1,790 million (up 9.1% on a consolidated basis and up 5.4% like-for-like), with a €22 million negative foreign exchange impact (Polish zloty and Australian, New Zealand and Canadian dollars). The scope effect was a positive €93 million.

Travel Retail delivered strong growth despite the impact of terrorist attacks in Europe thanks to strong network momentum. Paradies performance as well as synergies are in line with Group’s expectations.

The figures below are presented on a like-for-like basis.

In first-half 2016, Travel Retail activities were up by 7.8%. This performance was led by network expansion, the roll-out of new concepts, and an improved product mix, which offset the impact of terrorist attacks in Europe on tourist activities.

In France, business held firm over the period (up 0.3%). The slowdown in the Duty Free and Fashion segments following the Paris and Brussels terrorist attacks and the impact of Chinese passengers was countered by the good performance of the Travel Essentials and Foodservice segments on the back of network expansion.

Europe (excluding France) reported bullish momentum (up 12.0%), spurred by network development particularly in Poland (up 29.0%), and the start-up of activities in Iceland and Luxembourg. The fast-paced growth of operations in Italy (up 8.4%) continued during the period, lifted by the growth in traffic and the opening of new sales outlets.

Romania also posted strong growth (up 24.4%) lifted by the rise in tobacco prices, as did the Czech Republic (up 5.0%), despite the impact of lower spending by Russian passengers in Duty Free businesses.

Trading also expanded in North America (up 5.1%) on the back of network development and good performances from the legacy business.

The Asia-Pacific region is also growing (up 15.0%), lifted by the continued development of Fashion activities in China and the start-up of Duty Free activities in Auckland airport in July 2015.

In first-half 2016, the Distribution business was down 3.1%, hit once again by discontinued export sales in Hungary.

Recurring EBIT

Recurring EBIT was €6 million higher year-on-year, at +€36 million.

Travel Retail was up by €12 million, buoyed by the consolidation of new activities including Paradies, although this was dented by the impact of new activities starting up in New Zealand and new platform launch costs, particularly in Poland. Despite the impact of terrorist attacks on tourism, estimated at a negative €4 million over the six-month period, Travel Retail delivered a strong performance in Europe, particularly in Italy and the Netherlands.

Distribution declined by €6 million following the disposal of operations in Switzerland, the US and Spain.

Lagardère Active

Revenue

Revenue totalled €436 million, down 0.5% on a consolidated basis and down 7.4% like-for-like. The difference between the two figures corresponds to a €31 million positive scope impact, mainly reflecting the consolidation of Grupo Boomerang TV.

The figures below are presented on a like-for-like basis.

The performance remained uneven, with an unfavourable comparison effect for Lagardère Studios.

The 6.8% contraction in Magazine Publishing is related to the 10.4% fall in advertising revenues, despite circulation proving resilient (down 2.1%).

The Radio segment had a good first half, up 3.4% on the back of robust growth in musical radio both in France (up 11.2%) and internationally (up 2.7%).

Television (TV Channels and TV Production) declined sharply in the first half (down 17.1%) owing to TV Production, and had to contend with a strong comparative first-half 2015 which had seen bullish sales of rights and a favourable delivery schedule.

Excluding LeGuide.com, which remains in decline (down 24.0%), pure-play digital and B2B revenue rose 8.4%, primarily driven by diversification into e-health and BilletReduc ticketing services.

Advertising revenue fell 3.3% for the division as a whole.

Recurring EBIT

Recurring EBIT was stable at €33 million. In addition to the consolidation of Grupo Boomerang TV, the cost cutting plans put in place helped offset the downturn in the Press business, as well as the negative impact of delivery scheduling on Lagardère Studios.

Lagardère Sports and Entertainment

Revenue

Revenue totalled €235 million, down 9.0% on a consolidated basis and down 11.7% like-for-like. The difference between these two figures can be explained by a €1 million negative foreign exchange impact and a positive €7 million scope effect, notably related to Marketing and Consulting activities carried out in Europe in

second-half 2015.

The fall in revenue in first-half 2016 is attributable to an unfavourable sporting calendar effect, as two major football championships were held in first-half 2015, namely the Orange Africa Cup of Nations and the AFC Asian Cup, that were not held in 2016. Excluding the cyclical impact of the sporting calendar, the rest of the division delivered a good performance led by the football businesses in the UK and France.

Recurring EBIT

Recurring EBIT amounted to €5 million versus €32 million in first-half 2015. As expected, seasonal fluctuations had an adverse impact in first-half 2016, particularly given the busy sporting calendar in the first-half 2015 comparative period.

Other activities

Recurring EBIT for Other activities was a negative €9 million and is stable compared to first-half 2015.

II- MAIN INCOME STATEMENT DATA

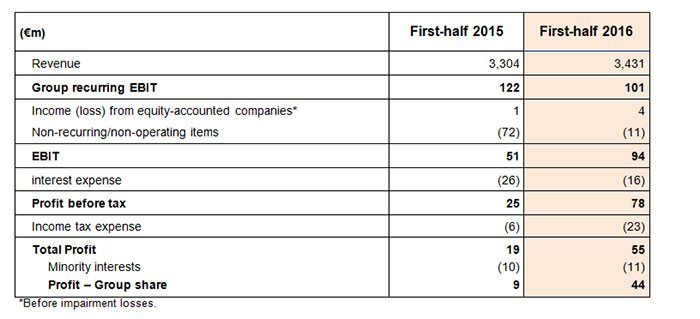

NON-RECURRING/NON-OPERATING ITEMS

Non-recurring/non-operating items came out at an expense of €11 million, and mainly comprised:

– -€74 million in restructuring costs, including -€52 million for Lagardère Active in connection with voluntary redundancy plans rolled out in first-half 2016 in the Magazine Publishing and Advertising Sales Brokerage businesses in France;

– impairment losses recognised against property, plant and equipment and intangible assets for -€39 million, including -€32 million for Lagardère Active in relation to LeGuide group goodwill;

– -€37 million in amortisation of intangible assets and other acquisition-related expenses for consolidated companies, including -€32 million at Lagardère Travel Retail;

– +€139 million in capital gains on disposals, including +€106 million relating to the sale of an office building leased to third parties (Other activities).

NET INTEREST EXPENSE

Net interest expense fell €10 million on first-half 2015 owing to the favourable impact of the sale of all Deutsche Telekom shares and the decrease in the average cost of the Group’s debt.

INCOME TAX EXPENSE

Income tax expense for the six months to 30 June 2016 came to -€23 million versus -€6 million for first-half 2015. The increase in this item is mainly linked to the tax related to the sale of an office building in France.

PROFIT FOR THE PERIOD

Including the items set out above, profit for the period came out at €55 million, including €44 million attributable to the Group.

ADJUSTED PROFIT – GROUP SHARE

III- OTHER FINANCIAL INFORMATION

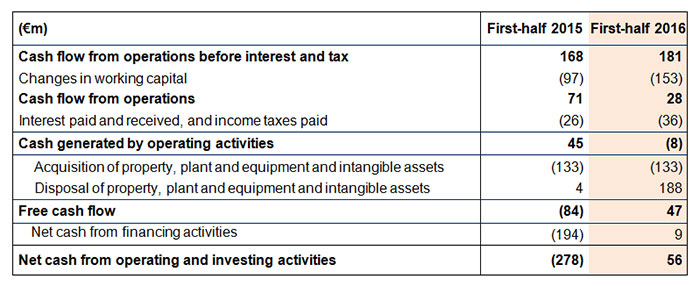

TOTAL CASH FLOWS FROM OPERATING AND INVESTING ACTIVITIES

– Cash flow amounted to €181 million, up 7.7% year-on-year. All of the Group’s businesses contributed to the cash flow increase, with the exception of Lagardère Sports and Entertainment, hit by the calendar effect described above.

– Changes in working capital (typically negative in the first half) represented a negative €153 million. The decline is attributable to Lagardère Travel Retail (deconsolidation of Distribution entities and development of new Travel Retail businesses), and Lagardère Sports and Entertainment due to non-recurring items (payment of the indemnity relating to the cricket dispute in India and adverse impact of the IOC contract terminating in mid-2016).

– Acquisitions of property, plant and equipment and intangible assets remained stable at -€133 million, and include specific efforts to expand the Travel Retail network.

FINANCIAL POSITION

Net debt stood at €1,739 million at 30 June 2016, an increase of €188 million compared to 31 December 2015, due chiefly to the adverse impact of seasonal fluctuations on debt at end-June.

Net debt was up just €303 million compared with 30 June 2015, despite the €485 million acquisition of Paradies, reflecting the Group’s tight rein on debt. Leverage (net debt/recurring EBITDA(6)) stands at 2.8x including the acquisition of Paradies, compared to 2.6x at 30 June 2015.

The Group’s liquidity position remains solid, with €1,643 million in available liquidity (available cash and short-term investments reported on the balance sheet for €393 million and authorised but undrawn credit lines totalling €1,250 million). The timing of debt repayments remains balanced.

IV- GUIDANCE

TARGET FOR 2016 GROUP RECURRING EBIT CONFIRMED

Based on our first-half performance in line with forecasts and our outlook for the second half, we can confirm our target on recurring EBIT for 2016 as announced in March.

Accordingly, Group recurring EBIT growth for 2016 is expected to be slightly above 10% compared to 2015 at constant exchange rates and excluding any impact from any disposal of Distribution activities.

V- HIGHLIGHTS SINCE THE PUBLICATION OF THE 2016 FIRST QUARTER REVENUE

Acquisition of Neon Play by Lagardère Publishing

On 17 June 2016, Lagardère Publishing’s subsidiary Hachette UK acquired Neon Play, a leading mobile games development studio in the UK.

Disposal of Press Distribution operations in Canada by Lagardère Travel Retail

As part of its strategy aimed at focusing on growth businesses, Lagardère Travel Retail continued the divestiture of its Distribution business and on 31 May announced the sale of its Canadian press distribution operations.

Acquisition of a holding in a radio network in Cambodia by Lagardère Active

In June 2016, Lagardère Active acquired a 49% holding in LVMG, owner of two radio networks in Cambodia. The acquisition was made through its subsidiary Lagardère Active Radio International (LARI).

Sale by Lagardère Active of its holding in SETC

In May 2016, Lagardère Active sold shares in SETC (Société éditrice de Télécâble Sat Hebdo) to the Hommel group. The shares sold had been previously jointly owned with Hommel.

Firm offer to acquire the shares of LeGuide.com received by Lagardère Active

On 26 July 2016, Lagardère Active received a firm offer from online shopping search engine Kelkoo to acquire the shares of LeGuide.com, and accordingly has granted Kelkoo exclusivity to pursue discussions.

(1)Recurring operating profit of fully consolidated companies (four operating divisions and other activities). See definition at the end of the press release.

(2)At constant exchange rates and excluding any impact from any disposal of Distribution activities.

(3)At constant exchange rates and consolidation scope. See appendixes at the end of the press release.

(4)See definition at the end of the press release.

(5)See appendixes at the end of the press release.

(6) See definition at the end of the press release.

VI- INVESTOR CALENDAR

• Announcement of Q3 2016 revenue

Third-quarter revenue will be released on 10 November 2016 at 8:00 a.m. A conference call will be held at 11:00 a.m. on the same day.

VII- APPENDIXES

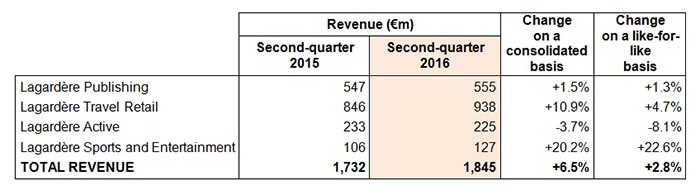

Q2 2016 REVENUE:

CHANGES IN CONSOLIDATION SCOPE AND OTHER

The difference between consolidated and like-for-like data is attributable to (i) a €42 million negative foreign exchange impact resulting mainly from the depreciation in the pound sterling, and (ii) a €153 million positive scope effect which breaks down as follows:

• Miscellaneous effects of revenue deconsolidation, representing a negative €185 million impact and relating to:

– Lagardère Travel Retail for a negative €170 million impact : sale of Distribution operations in Spain (SGEL), Switzerland (Naville group), and the US (Curtis);

– Lagardère Sports and Entertainment for a negative €12 million impact: sale of endurance and merchandising activities.

• Miscellaneous effects of revenue consolidation, representing a positive €338 million impact and chiefly relating to:

– Lagardère Travel Retail for a positive €262 million impact (including Paradies operations in the US);

– Lagardère Active for a positive €35 million impact (including Grupo Boomerang TV activities in Spain);

– Lagardère Publishing for a positive €22 million impact (including Perseus operations in the US);

– Lagardère Sports and Entertainment for a positive €19 million (Marketing and Consulting activities in Europe).

DEFINITIONS

Group recurring EBIT

Recurring EBIT of fully consolidated companies is defined as earnings before interest and tax, excluding the following income statement items:

• income (loss) from equity-accounted companies;

• gains (losses) on disposals of assets;

• impairment losses on goodwill, property, plant and equipment and intangible assets;

• restructuring costs;

• items related to business combinations:

– acquisition-related expenses;

– gains and losses resulting from acquisition price adjustments and fair value adjustments due to changes in control;

– amortisation of acquisition-related intangible assets.

Recurring EBITDA

Recurring EBITDA is defined as recurring EBIT of fully consolidated companies added with:

• depreciation and amortisation of intangible assets and property, plant and equipment;

• dividends received from equity-accounted companies.

Free cash flow

Cash generated by/(used in) operating activities, added with acquisitions/disposals of intangible assets and property, plant and equipment.

Press Contacts

Thierry FUNCK-BRENTANO - Tel: +33 1 40 69 16 34 - tfb@lagardere.fr

Ramzi KHIROUN - Tel: +33 1 40 69 16 33 - rk@lagardere.fr

Florence LONIS - Tel: +33 1 40 69 18 02 - flonis@lagardere.fr

The Lagardère group is a global leader in content publishing, production, broadcasting and distribution, whose powerful brands leverage its virtual and physical networks to attract and enjoy qualified audiences.

It is structured around four business lines: Books and e-Books; Travel Retail; Press, Audiovisual, Digital and Advertising Sales Brokerage; Sports and Entertainment.

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Email alert

To receive institutional press releases from the Lagardère group, please complete the following fields:

Register