Press releases

2015 FIRST HALF RESULTS

Corporate & other activities, Finance

Paris, July 30, 2015

Target for 2015 recurring EBIT(1) growth raised from +5% to +7%.

- Sales totalled €3,304 million, up +2.9% on a like-for-like basis(2).

- Group operating margin up by +0.4 point at 3.7%.

- Total recurring EBIT of €122 million, up +11%(3).

- Adjusted net profit(4) – Group share significantly up at €75 million.

In the first half of 2015, the solid performance of the Group was buoyed by Lagardère Unlimited, with a favourable calendar effect, and the continued growth of Travel Retail.

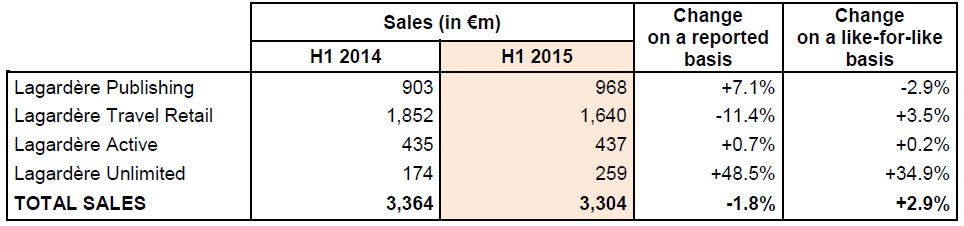

- Lagardère sales for the first half of 2015 totalled €3,304 million, with sustained growth of +2.9% like-for-like. Change on a reported basis (-1.8%) is due to a negative scope effect of -€277 million, mainly related to miscellaneous revenue deconsolidation (notably the disposal of some Press Distribution activities). The currency effect was positive (+€130 million).

- The Group’s operating margin was 3.7%, up by +0.4 point due to the total recurring EBIT (operating activities and other activities) of €122 million, representing sustained growth of 11%.

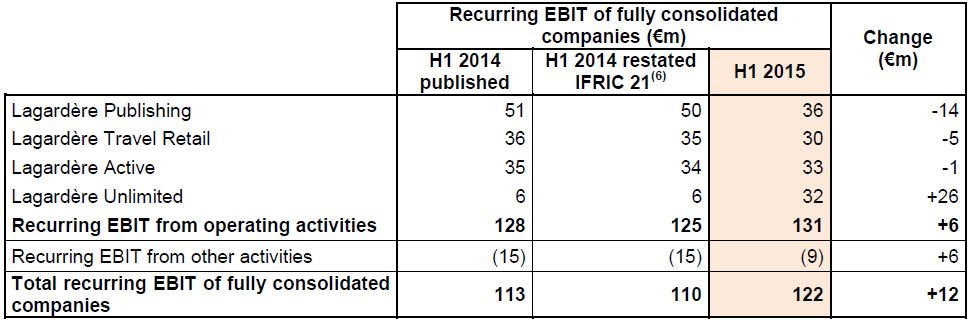

Recurring EBIT from operating activities amounted to €131 million. Growth at Lagardère Unlimited, which confirmed its recovery, had a significant impact on this figure.

– Lagardère Publishing: Recurring EBIT of €36 million, down -€14 million, related to the decline in activity, particularly in the US.

– Lagardère Travel Retail(5): Recurring EBIT of €30 million, down -€5 million, due to disposals in Switzerland and in the US.

– Lagardère Active: nearly stable Recurring EBIT of €33 million (-€1 million).

– Lagardère Unlimited: Recurring EBIT of €32 million, up significantly (+€26 million) due to a very favourable sporting events schedule. - Net profit – Group share rose significantly to €9 million, versus -€35 million in H1 2014, thanks to growth in Recurring EBIT and a decline in interest and tax expenses.

Adjusted net profit – Group share increased considerably to €75 million, versus €31 million in H1 2014. - Operating cash flow amounted to €45 million (+€171 million compared to H1 2014).

- Net debt was €1,436 million at 30 June 2015, up from 31 December 2014 (€954 million). This trend is essentially attributable to seasonal effects, which are traditionally negative in the first half, and to the payment of ordinary dividends.

I- SALES AND RECURRING EBIT

SALES

In the first half of 2015, Lagardère group sales totalled €3,304 million, up +2.9% on a like-for-like basis (-1.8% on a reported basis).

The difference between data on a reported basis and like-for-like is explained in part by a positive currency effect of €130 million, due primarily to appreciation of the US dollar and the pound sterling, and in part by a negative scope effect (-€277 million), broken down as follows:

- Miscellaneous effects of revenue deconsolidation, amounting to €384 million with, essentially:

– at Lagardère Travel Retail: deconsolidation of Relay activities in train stations in France (now consolidated using the equity method through the creation of a joint venture with SNCF) as well as high-street Retail activities in Poland (now consolidated using the equity method after disposal of 51% of Inmedio capital); disposal in Switzerland of Press Distribution activities and book stores (Payot);

– at Lagardère Active: disposal of 10 magazines. - €107 million in acquisitions at Lagardère Travel Retail (consolidation of Airest activities, primarily in Venice), Lagardère Active (acquisition of Grupo Boomerang TV and consolidation of Gulli revenue) and Lagardère Publishing (Quercus and Rising Stars in the United Kingdom).

H1 2015 sales:

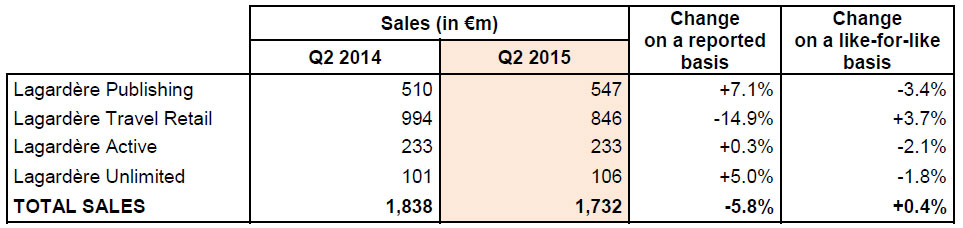

Q2 2015 sales:

RECURRING EBIT OF FULLY CONSOLIDATED COMPANIES

Lagardère Publishing

Sales

Sales of €968 million, up by +7.1% on a reported basis and down by -2.9% like-for-like. The difference can be explained by positive currency effects (+€70 million, primarily due to the appreciation of the US dollar and the pound sterling), as well as the scope effect (+€20 million).

In the first half of 2015, activity declined as expected, mainly due to the downturn in the US (unfavourable comparison base relative to the first half of 2014), which was not offset by the high level of activity in France.

Figures below are presented on a like-for-like basis.

In France, business grew sharply by +3%, due to the positive trend in General Literature, with the success of new releases on one hand (L’homme qui ment, by Marc Lavoine, Hippocrate aux enfers, by Michel Cymes, Vernon Subutex, by Virginie Despentes, etc.) and the performance of the Paperback segment (Fifty Shades saga) on the other. Meanwhile, Illustrated Books had a strong start of the year with the continued success of colouring books for adults.

In the United Kingdom, the downturn in sales (-3.5%) can be explained by a slate of new releases that was not as strong as the first half of 2014.

In the United States, the decline in activity, which had been expected (-7.8%), can be explained by the high level of activity in the first half of 2014 (including The Silkworm by Robert Galbraith and The Goldfinch by Donna Tartt) as well as a decline in e-book sales.

In the Spain/Latin America area, activity was down (-3.8%), particularly due to a postponement in Education sales in Spain.

The trend for Partworks (-3.4%) can be explained by a smaller volume of launches at the end of 2014.

Digital: in the 1st half of 2015, the weighting of e-books in Lagardère Publishing total sales declined to 10.7%, compared to 11.3% at the end of June 2014. This transition remains limited to English-speaking countries and to the General Literature segment:

– in the United States, in a declining digital market (slowdown seen since the beginning of 2014), sales of e-books have dropped (24% of sales for Trade(7) vs. 29% at the end of June 2014), given a less successful slate of new releases and the implementation of the agreement with Amazon;

– in the United Kingdom, the market is stabilising and has been impacted by the January 1, 2015 VAT increase. E-books represented 33% of sales in Adult Trade(8) vs. 36% at the end of June 2014.

Recurring EBIT of fully consolidated companies

Lagardère Publishing posted Recurring EBIT of €36 million, down -€14 million compared to H1 2014. This change is mainly due to the decline of activity in the US, and to a lesser extent in the UK, which was not offset by the solid performance in France.

Lagardère Travel Retail

Note that the name of the Lagardère Services division has been changed to Lagardère Travel Retail. Pending their disposal, Distribution activities are still included in the division figures.

Sales

Sales for the division totalled €1,640 million (-11.4% on a reported basis and +3.5% like-for-like), with a favourable exchange rate effect this quarter of +€42 million (rise of the Swiss franc and the US, Australian, Canadian and Singaporean dollars). As expected, the scope effect was negative by -€306 million, broken down as follows:

- Miscellaneous effects of sales deconsolidation, amounting to €360 million, with, essentially:

– deconsolidation of Relay activities in train stations in France (now consolidated using the equity method through the creation of a joint venture with SNCF in September 2014) for -€159m, as well as high-street Retail activities in Poland (now consolidated using the equity method after disposal of 51% of Inmedio capital in December 2014) for -€55m;

– the disposal in Switzerland of Distribution activities in February 2015, with an impact of -€107m, and of Payot book stores in July 2014 with an impact of -€25m. - Acquisitions for €54m, essentially the Airest Group activities (notably at the Venice Airport) starting in April 2014.

The division is continuing the strategic transition of its activity mix with Travel Retail now accounting for 70% of the total (7 points higher than H1 2014), vs. 30% for Distribution (Press Distribution and Integrated Retail).

Figures below are presented on a like-for-like basis.

Growth in activity accelerated in the second quarter (+3.7%, after first quarter growth of +3.2%).

In the 1st half of 2015, Travel Retail activities were up by +7.3%. Performance was driven by growth in passenger traffic, the strong performance of acquisitions, expansion of networks and rollout of new concepts. Growth in the second quarter (+7.8%) was higher than in the first quarter (+6.7%).

In France, activity grew considerably over the first half (+8.7%), due to the Duty Free segment (increase in traffic and average spending per passenger), in addition to the solid performance of Travel Essentials and Foodservice segments.

Europe (excluding France), posted excellent performance (+7.9%): increased traffic and development of networks led to significant growth in Poland (+11.8%), Italy (+7.3%), where the ramping-up of activities in Rome airport continued (+13.9% despite the fire in May), as well as Romania (+15.5%) and Spain (+10.6%).

Activity was also up in North America (+5.7%) due to the network expansion in airport and a solid level of underlying activity.

The Asia-Pacific region is also growing (+3.2%), due to the sustained development of fashion activities in China and Singapore.

In the 1st half of 2015, Distribution activities declined by -4.0%, with market diversification efforts not completely offsetting the decline in the print press market.

Recurring EBIT of fully consolidated companies

Recurring EBIT of fully consolidated companies was at €30m, down by -€5m, due to disposals in Switzerland and the US, which had a negative impact of €4m.

Recurring EBIT of fully consolidated companies for Travel Retail grew by +€3m, due to the continued improvement of the product mix, to winning new contracts and to the successful launch of new concepts.

Meanwhile the integration of Airest activities had a €3m negative impact (unfavourable seasonal effect in the 1st quarter).

Recurring EBIT of fully consolidated companies for Distribution was down -€1m, in line with the activity, taking into account the efforts in savings implemented.

Lagardère Active

Sales

Sales totalled €437m, up +0.7% on a reported basis and up +0.2% like-for-like. The difference between the two trends is essentially explained by a slightly positive scope effect (+€3m): the acquisition of Grupo Boomerang TV on May 31, 2015 and the consolidation of Gulli revenue (resulting from the purchase of France TV’s 34% stake in November 2014), offsetting the disposal of 10 magazines in July 2014.

Sales for advertising fell 3.5% for the division as a whole.

Figures below are presented on a like-for-like basis.

The negative trend in Magazine Publishing, which posted a -4.7% decline, is due to the drop in advertising revenue (-6.5%) and circulation (-7.1%), and is partly offset by growth in other activities, particularly in digital (+19%).

Radio posted mixed performances (-3.9%) with a downturn at Europe 1, while music radio in France and internationally was up.

Television activities (theme channels and TV Production) recorded solid growth (+28.1%) thanks to TV Production (+44.9%) due to both to H1 2014 at a low level and positive effects in 2015 related to rights selling and a favourable delivery schedule, particularly in fiction programmes.

In pure digital activities, the decline (-20%) is explained by the LeGuide group, which continues to face challenges with algorithm changes by Google. Excluding the LeGuide group, these activities recorded +5.4% growth.

Recurring EBIT of fully consolidated companies

Recurring EBIT of fully consolidated companies is virtually stable at €33m (-€1m), as the solid performance in TV Production (which benefited from a favourable calendar impact) and the effects of cost-cutting plans implemented in 2014 almost entirely offset the negative trends in advertising and circulation, and the decline in the LeGuide group activity.

Lagardère Unlimited

Sales

Sales rose considerably to €259m: up 48.5% on a reported basis and up 34.9% like-for-like. The difference between these two figures can be explained by positive currency (+€18m) and scope effects (+€6m), notably related to the Casino de Paris acquisition in March 2014.

The very sharp increase in activity can be explained by a very favourable calendar effect related to the good completion of contracts for two continental football competitions, the Africa Cup of Nations held in Equatorial Guinea and the AFC Asian Cup held in Australia.

Recurring EBIT of fully consolidated companies

Recurring EBIT of fully consolidated companies amounted to €32m versus €6m in H1 2014. As expected, 2015 has been marked by a very positive seasonal effect, given a very active sport calendar in the first half of the year.

The underlying profitability of other activities is improving in line with the recovery plan implemented by the division.

Other activities

The recurring EBIT from other activities amounted to -€9m, a +€6m improvement compared to H1 2014, which still included losses from Matra Manufacturing & Services, whose light electrical vehicle manufacturing and marketing business was sold in December 2014.

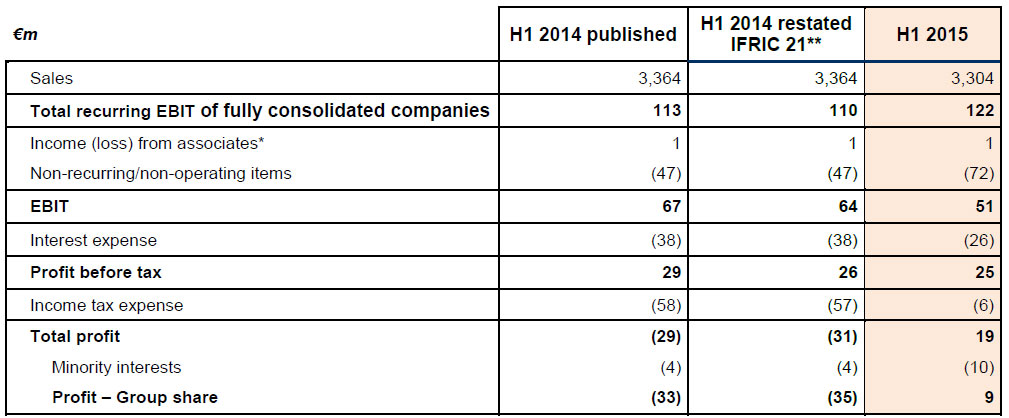

II- MAIN INCOME STATEMENT DATA

*Before impairment losses.

**H1 2014 figures have been restated to reflect the retroactive application of the IFRIC 21 interpretation “Levies charged by Public Authorities”:

- -€3 million for the recurring EBIT of fully consolidated companies;

- -€2 million for net profit – Group share and adjusted net profit – Group share.

The new IFRIC 21 interpretation changes the obligating event used to record a liability related to paying a tax or a contribution. The obligating event that gives rise to a liability is now the date upon which the fiscal liability comes due.

CONTRIBUTION FROM ASSOCIATES

Income from associates (excluding impairment losses) amounted to €1 million and was stable compared to H1 2014.

NON-RECURRING/NON-OPERATING ITEMS

Non-recurring/non-operating items totalled -€72 million, and mainly comprised:

– restructuring costs at -€35m, including -€13m at Lagardère Active which relates mainly to its advertising brokerage activities in regions (Lagardère Métropoles) and -€12m at Lagardère Unlimited, due to the reorganisation of the division in Europe. The remainder is broken down between Lagardère Publishing (-€6m) and Lagardère Travel Retail (-€4m) and is essentially related to the implementation of cost-cutting plans.

– Impairments on tangible and intangible assets at -€30m, including -€27m at Lagardère Active, mainly in relation to the partial impairment of goodwill for the LeGuide group for -€25 million.

– -€26m in amortisation of intangible assets and other acquisition-related expenses, including -€20 million at Lagardère Travel Retail;

– capital gains on disposals of €19m, including €17m at Lagardère Travel Retail, essentially from a capital gain on the disposal of Distribution activities in Switzerland (€32m), as well as a capital loss related to the sale of the US Distribution subsidiary Curtis Circulation Company (-€12m).

EARNINGS BEFORE INTEREST AND TAX

At 30 June 2015, EBIT totalled €51 million versus €64 million at 30 June 2014.

NET INTEREST EXPENSE

Net interest expense amounted to -€26 million in H1 2015, a €12 million decline compared to H1 2014. This change is mainly due to the decline in the average cost of debt for the Group between the two periods.

INCOME TAX EXPENSE

At 30 June 2015, income tax expense came to €6 million versus €57 million at 30 June 2014. This change is due to the 3% additional contribution enforced in France on dividends paid (€5 million in H1 2015 versus €28 million in H1 2014, taking into account the exceptional dividend), as well as a favourable change in the geographic mix related to the tax rate for foreign companies.

PROFIT

Including all these items, profit came out to €19 million, of which €9 million is attributable to the Group share. The share of profit attributed to minority interests amounted to €10 million at June 30, 2015, versus €4 million at the end of June 2014. This change in income is mainly the result of the growth in profit for the World Sport Group.

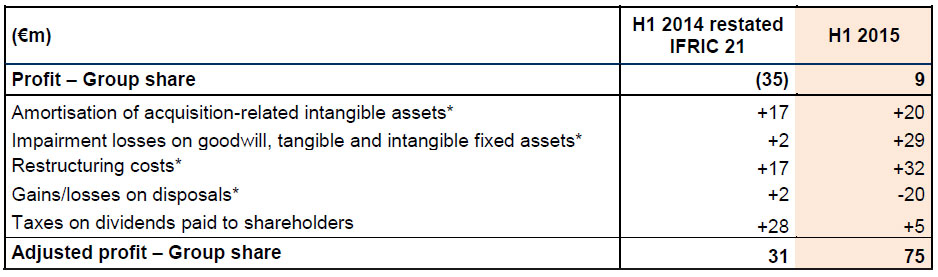

ADJUSTED PROFIT – GROUP SHARE

*Net of tax.

III- OTHER FINANCIAL INFORMATION

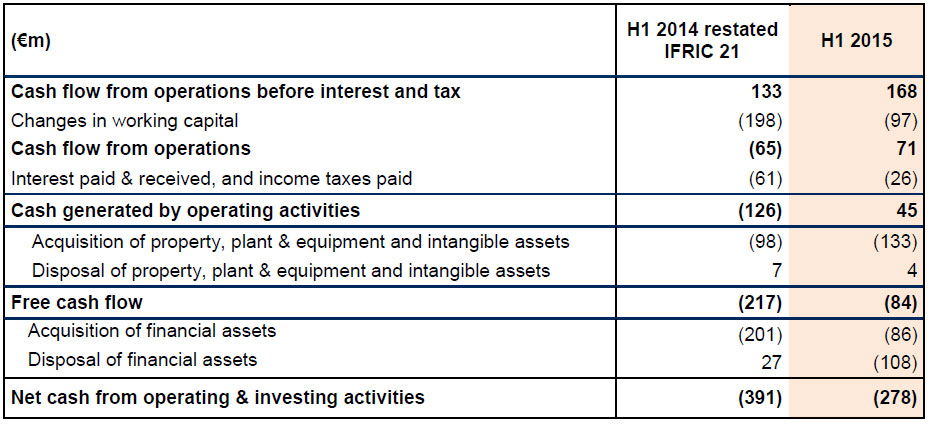

TOTAL CASH FLOWS FROM OPERATING AND INVESTING ACTIVITIES

Cash flow from operations amounted to €45 million in the first half of 2015, versus -€126 million at 30 June 2014, up +€171 million.

- Cash flow amounted to €168 million, versus €133 million at 30 June 2014. This trend reflects the growth in operating income (+€12 million) as well as the impact of lower provisions for amortisation and depreciation (+€17 million). The two effects are partially offset by the increase in the disbursement of restructuring expenses (amounting to €4 million).

- The change in working capital requirement (WCR), which is normally negative at the end of June, improved considerably in the first half of 2015, coming to -€97 million, compared to -€198 million over the same period last year. This progress is attributable to a significant improvement at Lagardère Travel Retail, in light of a 2014 comparison base undermined by several non-recurring factors, as well as at Lagardère Publishing after a particularly high year in 2014 in terms of author advances in the US and the payment of debts to authors in France (royalties for success in 2013). In contrast, there was a negative trend at Lagardère Unlimited thanks to receivables during 2014 for major events occurring at the beginning of 2015 (AFC Asian Cup and Africa Cup of Nations).

- Interests paid (net of received interest) came to -€5 million, vs. -€4 million at 30 June 2014. Last year, this interest included financial income generated by a favourable average cash situation for the first half of 2014.

- Tax paid amounted to -€21 million, vs. -€57 million at the end of June 2014, with these amounts including the additional contribution on dividends paid in the amount of -€5 million this year, vs. -€28 million last year.

Investment flows fell to -€219 million, versus -€299 million at 30 June 2014.

- Investments in intangible assets totalled -€133 million. They primarily occurred at Lagardère Travel Retail (development of networks), Lagardère Unlimited (acquisition of sport rights) and Lagardère Publishing (particularly the new headquarters in France and the United Kingdom). At 30 June 2014, they represented -€98 million, and were mainly related to Lagardère Travel Retail.

- Financial investments amounted to -€86 million at 30 June 2015. They are mainly related, at Lagardère Active, to the acquisition of Grupo Boomerang TV, and to a lesser extent, at Lagardère Travel Retail, to the acquisition of 17 points of sale at JFK airport in New York. They also include the payment by Lagardère Unlimited of a guarantee deposit related to the AFC (World Sport Group) contract.

Financial asset disposals totalled -€108 million for the first half of 2015. They resulted from the sale by Lagardère Travel Retail of its Press Distribution and Integrated Retail activities in Switzerland, and of Curtis Circulation Company (national Distribution of magazines in the US), the latter transaction leading to the deconsolidation of a structurally favourable working capital resource in this activity.

All in all, the sum of operating and investment flows came to a negative €278 million, vs. a negative €391 million at 30 June 2014, an improvement mainly attributable to the growth in cash flow as well as the change in working capital requirements.

FINANCIAL POSITION

Net debt was €1,436 million at 30 June 2015, up €482 million from 31 December 2014. This is due essentially to the payment of ordinary dividends (€184 million), the negative change in WCR in H1 2015, and acquisitions made.

The Group’s liquidity position is still solid, with €1,701 million in available liquidity (available cash and short-term investments reported on the balance sheet totalling €451 million and authorised but undrawn credit lines of credit of €1,250 million). The debt repayment schedule remains balanced.

IV- HIGHLIGHTS SINCE THE PUBLICATION OF SALES FOR THE FIRST QUARTER OF 2015

Acquisition of the TV production group Grupo Boomerang TV

On 28 May 2015, in line with its European development strategy, Lagardère Active announced that it had purchased a majority stake of 82% in Grupo Boomerang TV (Grupo BTV), one of Spain’s leading independent TV production groups (fiction and unscripted) with developments in Latin America. The company had a turnover of €42 million in 2014.

Acquisition of the German group akzio! ajoint.

On 8 June 2015, Lagardère Unlimited acquired the group akzio! ajoint., the leading sponsorship consulting agency in Germany. With this acquisition, Lagardère Unlimited expands its service portfolio in Europe, in line with its global growth strategy in consulting and brand activation services.

Renewal of partnership agreement between CAF and Sportfive

On 12 June 2015, the Confédération Africaine de Football (CAF) and Sportfive signed a landmark agreement to extend their partnership until 2028. Sportfive, an agency of Lagardère Unlimited, will continue to sell the marketing and media rights of CAF’s main regional competitions in Africa, including the Africa Cup of Nations, African Nations Championship and African Champions League.

Disposal by Lagardère Travel Retail of its US magazine distribution subsidiary

As part of its strategy aimed at focusing on growth businesses, Lagardère Travel Retail continued the divestiture of its press Distribution business, and announced on 6 July 2015 the disposal of its subsidiary Curtis Circulation Company to its management team.

Curtis Circulation Company is one of the largest US magazine distributors with approximately 25% market share of the single copy marketplace across the USA and Canada. Curtis’ unique business model differs from the other European Distribution companies within Lagardère Travel Retail.

Public buyout offer for shares in Lagardère Active Broadcast

On 7 July 2015, Lagardère Active, a subsidiary of Lagardère SCA, announced it had filed a draft public buyout offer for all of the shares of Lagardère Active Broadcast not held by Lagardère Active.

It would simplify Lagardère Active Broadcast’s legal processes, as well as providing cost savings (especially on listing fees).

Lagardère Active owns 99.50% of the share capital and 99.59% of voting rights of Lagardère Active Broadcast, which is a public limited company incorporated under Monegasque law. The company is Lagardère Active’s audiovisual division and has radio stations in France (Europe 1, music stations) and abroad (Eastern Europe, French-speaking Africa), TV production and distribution (Lagardère Entertainment) and theme TV channels (particularly Gulli).

Draft Public buyout offer with squeeze-out on LeGuide.com shares

Lagardère Active, a subsidiary of Lagardère SCA, announces a draft public buyout offer for all of the shares of LeGuide.com not held by Lagardère Active.

These shares representing less than 5% of the capital and voting rights of LeGuide.com, the offer will be immediately followed by a mandatory squeeze-out process. For the record, these shares are listed on Alternext of Euronext Paris.

The price proposed by Lagardère Active is €32.50 per share, representing a maximum aggregate acquisition cost (excluding fees and commission) of about €4.8 million for all the shares covered by the offer and the mandatory squeeze-out.

The operation aims to proceed with the delisting of the company LeGuide.com, this listing appearing no longer justified considering the purposes initially pursued, given the discrepancy that emerged between the stock price and the real financial situation of the company.

The offer will also provide minority shareholders of LeGuide.com with an immediate liquidity on their shares in a market with very low liquidity.

Lagardère Active and LeGuide.com joint draft offer document will be filed with the French financial markets authority (Autorité des marchés financiers – AMF) on 31 July 2015 and made publicly available. This draft offer document and the operation remain subject to approval by the AMF.

V- OUTLOOK – GUIDANCE

TARGET FOR 2015 RECURRING EBIT GROWTH RAISED

The first half results, as well as the outlook for the second half, enable to raise the target on 2015 recurring EBIT announced last March.

From now on, Group Recurring EBIT of fully consolidated companies (from operating activities and other activities) should increase in 2015 by about +7%, compared to 2014 (versus +5% previously), at constant exchange rates and excluding the effect of potential disposal of LS distribution activities.

INVESTOR CALENDAR

- Announcement of Q3 2015 sales

Third-quarter results will be released on November 10, 2015 at 8:00 a.m. A conference call will be held at 10:00 a.m. on the same day.

DEFINITION OF RECURRING EBIT

Recurring EBIT of fully consolidated companies is defined as the difference between income before interest and tax and the following items of the income statement:

- contribution of associates;

- gains or losses on disposals of assets;

- impairment losses on goodwill, property, plant and equipment and intangible assets;

- restructuring costs;

- items related to business combinations:

– expenses on acquisitions;

– gains and losses resulting from acquisition price adjustments and valuation adjustments related to changes in controlling interests;

– amortisation of acquisition-related intangible assets.

(1)Recurring operating profit of fully consolidated companies (four operating divisions and other activities). See details at the end of the press release.

(2)At constant exchange rates and consolidation scope.

(3)H1 2014 figures have been restated to reflect the retroactive application of the IFRIC 21 interpretation “Levies Charged by Public Authorities”:

- -€3 million for the recurring EBIT of fully consolidated companies;

- -€2 million for net profit – Group share and adjusted net profit – Group share.

(4)Excluding non-recurring/non-operational items.

(5)New name for the Lagardère Services division.

(6)See note under the table “Main Income Statement Data”.

(7)Trade works.

(8)Adult trade works.

Press Contacts

- Thierry FUNCK-BRENTANO - tel. +33 1 40 69 16 34 - tfb@lagardere.fr

- Ramzi KHIROUN - tel. +33 1 40 69 16 33 - rk@lagardere.fr

Investor Relations Contact

- Anthony MELLOR - tel. +33 1 40 69 18 02 - amellor@lagardere.fr

Email alert

To receive institutional press releases from the Lagardère group, please complete the following fields:

Register