Press releases

2014 ANNUAL RESULTS

Corporate & other activities, Finance

Paris, 11 march 2015

Growth of recurring Media EBIT(1): +2.9%(2) to €379m

• Group operating margin : 4.8% vs 4.5% in 2013

• Recurring Group EBIT +4.7% to €342m

• Adjusted net profit(3) +7.6% to €185m

Proposed ordinary dividend unchanged at €1.3 per share

A solid financial position

2015 guidance on recurring Group EBIT: about +5% compared to 2014(4)

In 2014, the Lagardère group’s operating performance featured improved profitability (with a margin of 4.8% in 2014 vs. 4.5% in 2013).

Growth in recurring Media EBIT (+2.9% on a like-for-like basis(2)) is above the guidance(5), thanks to the recovery at Lagardère Unlimited, tight cost control in other units and a significant improvement in Travel Retail.

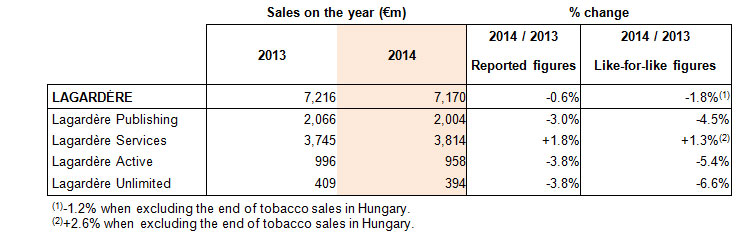

> Sales came to €7,170m, -0.6% in reported figures and -1.8% on a like-for-like basis( ), with an improvement at the end of the year.

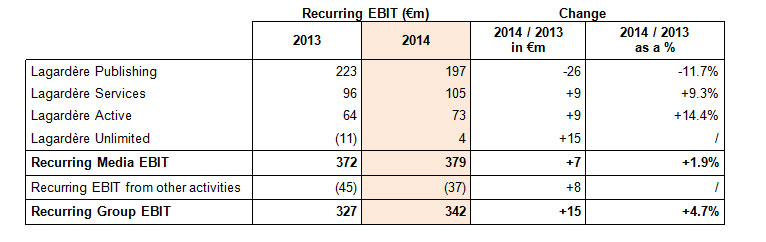

> Recurring Media EBIT amounted to €379m, up €7m compared to 2013:

– Lagardère Publishing: the operating margin remained high (9.8%) but receded slightly by 1 point; Recurring EBIT amounted to €197m, down by -€26m with an unfavourable basis of comparison in General Literature in France and English-speaking countries, after a very strong year in 2013 for best-sellers. Cost-cutting measures helped to reduce this effect.

– Lagardère Services: Recurring EBIT rose by €9m to €105m, thanks to the sharp increase in Travel Retail activities.

– Lagardère Active: Recurring EBIT rose by €9m to €73m. The operating margin improved, driven by ongoing cost-cutting.

– Lagardère Unlimited: the recovery is on track, with positive recurring EBIT of €4m, up by +€15m.

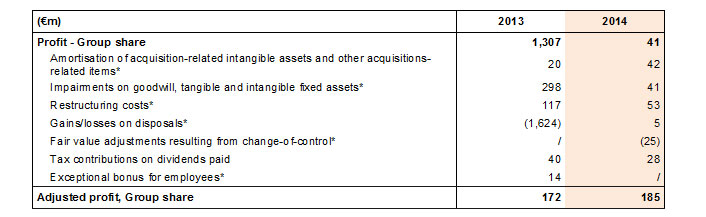

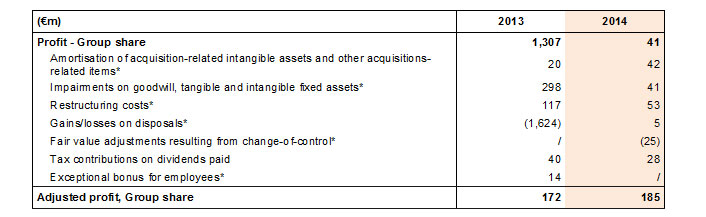

> Net profit – Group share amounted to €41m, vs. €1,307m in 2013, which included the €1,823m capital gain on the disposal of the EADS stake. Adjusted net profit – Group share came to €185m, a +7.6% increase compared to 2013, reflecting mainly the increase in recurring Group EBIT and the improvement in net financial income.

> The Group’s financial situation was solid with net debt of €954m at end-2014, vs. net cash of €361m at end-2013. This change is mainly due to dividend payments (an exceptional distribution and the ordinary dividend). The cash situation remains healthy and gearing (net debt / equity) of 46% and leverage ratios (net debt / recurring EBITDA(7)), at 1.8x, are in line with Group objectives.

I- SALES AND RECURRING EBIT

Sales came to €7,170m, or -1.8% on a like-for-like basis and -0.6% in reported figures.

The difference between the like-for-like and reported figures was caused mainly to a positive +€108m perimeter, due, in turn, mainly to acquisitions in 2014 at Lagardère Services – Gerzon Holding (Amsterdam Schiphol airport) and Airest Group (including the Venice airport) – and, to a lesser extent, Lagardère Active (Groupe Réservoir and France Télévisions’ 34% stake in Gulli) and Lagardère Publishing (in the United Kingdom). Exchange-rate shifts had a negative impact of -€27m (mainly at Lagardère Services, due to the depreciation of the Australian dollar, the Hungarian forint, and the Canadian dollar vs. the euro).

Recurring Media EBIT amounted to €379m, +1.9%.

When excluding the impact of the July 2014 disposal of the Payot bookshops in Switzerland, whose contribution amounted to €3m between July and December 2013, recurring Media EBIT rose by +2.9%, slightly more than guidance range (i.e., growth about in the middle of a range of 0% to +5% at constant forex). The forex impact was not significant in 2014.

Recurring Group EBIT (i.e., recurring Media EBIT and other activities) amounted to €342m, +4.7% compared to 2013.

> Lagardère Publishing: the operating margin remains high

Sales

Sales 2014 came to €2,004m, -3% in reported figures and -4.5% on a like-for-like basis.

2014 was a transition year for Lagardère Publishing, whose top-line figure, as expected, was marked an unfavourable comparison driven by the large number of best-sellers in 2013. Note also the significant decline in Education, due to the lack of renewal of Textbook programmes, particularly in France.

Profitability

The operating margin remains high, at 9.8% but nonetheless receded by one point. Recurring EBIT at Lagardère Publishing amounted to €197m, -€26m compared to 2013. This shift was due mainly to the contraction of activity in General Literature in France and in English-speaking countries. The implementation of cost-cutting nonetheless helped limit its effects.

> Lagardère Services: acceleration of growth at Travel Retail and increase in recurring EBIT

Sales

Sales in 2014 came to €3,814m, +1.8% in reported figures and +1.3% in like-for-like figures. When excluding the impact of the end of tobacco sales in Hungary, like-for-like growth would have been +2.6%. The strategic transformation continues at Lagardère Services, and Travel Retail now accounts for 63% of total consolidated net sales, vs. 60% in 2013.

The market environment in 2014 featured growth in air traffic at a brisker pace than in 2013, and the continued decline in the press market. Lagardère Services’ development strategy paid off with an acceleration in organic growth in Travel Retail in the second half.

Profitability

The operating margin amounted to 2.7%, a very slight improvement, with a recurring EBIT up +€9m to €105m.

This improvement was due to the solid performance at Travel Retail (+€15m) which, apart from the impact of growth in air traffic, was driven by a more favourable product mix, the successful development of new concepts and the contribution of acquisitions. The results of Distribution (down by -€6m) reflect weaker activity, which was nonetheless mitigated by the diversification strategy and tight cost control.

> Lagardère Active: improvement in profitability thanks to cost-cutting plans

Sales

Sales of €958m in 2014, or -3.8% in reported figures and -5.4% in like-for-like figures. The contraction in sales was due mainly to the decline at Magazines (-6.4% in 2014). Radio demonstrated its defensive character, as it was stable on the whole and up internationally. All in all, advertising was down 4.2% and broadcasting by 3.5%.

Profitability

In this challenging environment, Lagardère Active managed to improve its operating margin by 1.2 point to 7.6%, with Recurring EBIT of €73m, up €9m. Ongoing cost-cutting plans more than offset the negative impact of the decline in net sales at Magazines.

> Lagardère Unlimited: recovery is on track

Sales

Sales came to €394m, a 3.8% decline in reported figures and a 6.6% decline on a like-for-like basis. The expected impact of the football calendar, mainly driven by no Africa Cup of Nations in 2014 and the continued phasing out of the media rights trading activities from Sportfive International explains the reduction in sales volume.

These factors are partly offset by the good performances of competitions organised in Asia (women’s tennis and football), and Hospitality operations related to the FIFA World Cup in Brazil.

Profitability

Lagardère Unlimited’s recovery is on track, with recurring EBIT of €4m, up €15m. The unit was able to achieve a positive operating profit despite a slow year in sports events for Lagardère Unlimited in 2014, the cost-saving plan linked to the halt of the main media rights selling activities at Sportfive International, and the shutdown of loss-making businesses.

Recurring EBIT from other activities amounted to -€37m, an improvement (+€8m). It was affected mainly by losses at Matra Manufacturing Services (whose light electrical vehicle manufacturing and marketing business was sold in December 2014), and by residual costs incurred by exceptional disposals in 2013 (EADS and Canal+ France).

II- OTHER INCOME STATEMENT ITEMS

CONSOLIDATED INCOME STATEMENT

*before impairment losses.

CONTRIBUTION OF EQUITY-ACCOUNTED COMPANIES

Net profit from equity-accounted companies (before impairments) amounted to €9m, up slightly compared to the 2013 financial year (€7m), owing mainly to the increased contribution from the Marie Claire group.

NON-RECURRING / NON-OPERATING ITEMS

Non-recurring/non-operating items came to -€142m, vs. +€1,193m in 2013, which included the EADS capital gain (€1,823m). These included mainly:

• -€66m in restructuring costs, including -€21m at Lagardère Publishing (in the United Kingdom and the United States), -€16m at Lagardère Services (mostly in distribution activities in Belgium), and the balance mainly at Lagardère Active and Lagardère Unlimited.

• -€55m in amortisation of intangible assets and other acquisition-related expenses, including -€43m at Lagardère Services, -€7m at Lagardère Unlimited and -€5m at Lagardère Publishing.

• -€41m in impairments on tangible and intangible assets, including -€20m at Lagardère Services on the acquisition goodwill on Curtis (Lagardère Services’ US distribution subsidiary), and -€16m at Lagardère Active, due to the partial impairment of goodwill on LeGuide group, as a result of the persistent decline in activity at the Ciao subsidiary in Germany.

• -€5m in capital losses on disposals including mainly a loss of -€8m at Lagardère Active due to the capital loss realised in July 2014 on the disposal of 10 magazine titles, a loss of -€4m at Lagardère Publishing on the disposal of Aique (an Argentinean subsidiary), and a +€13m profit at Lagardère Services on the disposal of the Payot bookshops and 51% stake in Inmedio.

• +€25m in fair value adjustments resulting from change-of-control, including +€19m at Lagardère Active due to the new majority stake in Gulli (previously 66% held), and +€6m at Lagardère Services, after the partial disposal of Inmedio in Poland (with a residual stake of 49%).

PROFIT BEFORE INTEREST AND TAX

This amounted to €209m, vs. €1,527m in 2013, which included the capital gain on the EADS disposal.

NET INTEREST EXPENSE

Net interest expense came to -€73m in 2014, down €18m, due to the high 2013 amount (fees of the partial redemption of the bond maturing in 2014), and by the decline in the average cost of Group debt between 2013 and 2014.

INCOME TAX EXPENSE

The tax burden amounted to -€87m, down €30m compared to 2013. In 2014, it included, in the amount of €28m, the additional 3% contribution instituted in France on dividends paid out and the fact that goodwill impairments generate no tax deduction.

In light of all these items, total net profit came to €49m, of which €41m for the Group share and €8m for minority interests.

ADJUSTED PROFIT- GROUP SHARE

Adjusted profit – Group share (which excludes non-recurring / non-operating items) came to €185m, up €13m compared to 2013, reflecting mainly the increase in recurring EBIT.

*Net of tax.

PROFIT PER SHARE

Profit per share – Group share, came to €0.32, vs. €10.22 in 2013.

Adjusted profit per share – Group share, came to €1.45, vs. €1.34 in 2013.

The number of shares in share capital was unchanged in 2014.

III- OTHER FINANCIAL ITEMS

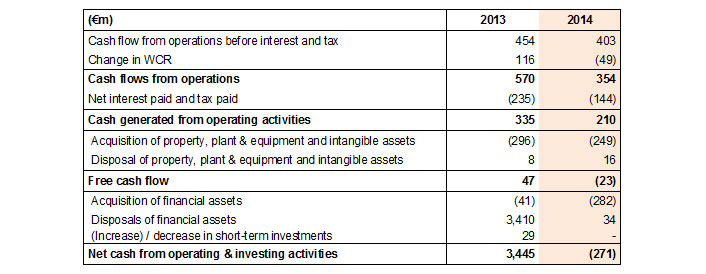

TOTAL CASH FLOW FROM OPERATING AND INVESTING ACTIVITIES

Cash flow from operations came to €354m in 2014, down €216m compared to 2013.

– Cash flow decreased to €403m, thus reflecting the impact of lower amortisations and depreciation (concentrated at Lagardère Unlimited, and due mainly to the phase-out of the media rights business at Sportfive International), the increase in restructuring costs disbursed during the year (at Lagardère Publishing, Lagardère Services and Lagardère Active mainly), with the effects only partly offset by an increase in dividends received from associates.

– The change in working capital requirement (WCR) was negative on the year at -€49m, after a very favourable change of +€116m in 2013. Almost half of this worsening is due to an unfavourable trend at Lagardère Publishing, driven by the increase in author advances in the United States (renewal of multi-title contracts) and the settlement of author debts in France (royalties on the 2013 successes). There was also a negative trend at Lagardère Active due to the decline in supplier debt (impact on sourcing of the decline in sales and cost-cutting plans), and at Lagardère Unlimited, due to receipts in 2013 on the International Olympic Committee contract at Sportfive International.

The sum of net paid interest and income tax paid came to -€144m in 2014, down considerably, by €91m compared to 2013.

– Paid interest (net of received interest) came to -€69m, vs. -€86m in 2013. Last year this included fees on the partial redemption of the bond maturing in October 2014.

– Income tax expense paid amounted to -€75m, vs. -€149m at end-December 2013, with these amounts including the additional contribution on dividends paid in the amount of -€28m in 2014. vs. -€40m in 2013.

Cash flow from investments came to -€531m.

– Acquisition of property, plant & equipment and intangible assets came to -€249m, down 16%. They were mainly in Lagardère Services (setting up of sales outlets to go with the expansion at Travel Retail) and Lagardère Publishing (one-off real-estate investments, particularly the new headquarters in France).

– Acquisition of financial assets came to -€282m, and at Lagardère Services deal mainly with strategic acquisitions in Travel Retail ̶ Gerzon Holding (fashion sales outlets at Schiphol airport) and Airest group (including activities at the Venice airport) ̶ and, to a lesser extent, various acquisitions at Lagardère Publishing (Constable & Robinson and Quercus, publishing fiction and non-fiction titles in the United Kingdom), Lagardère Unlimited (Casino de Paris), Lagardère Active (acquisition of France Télévisions’ 34% stake in Gulli).

€34m in financial assets were divested as part of the Group’s strategy to refocus on growing activities, including disposals of Lagardère Services’ stakes in Switzerland (Payot bookshops and a real-estate company) and in Poland (51% stake in Inmedio, a chain of downtown stores), and at Lagardère Active (disposal of 10 magazines in France).

All in all, total operating and investment cash flow came to a negative €271m, vs. a net positive €3,445m in 2013, which included major disposals of financial assets (EADS and Canal+ France).

FINANCIAL POSITION

As of the end of December 2014 the Group net debt was €954m, vs. net cash of €361m at end-December 2013. This change is due mainly to the payment of dividends (€961m including a €765m exceptional distribution, a €166m ordinary dividend and €16m paid out to minorities), as well as the amount of operating and investment flows.

– The Group’s liquidity situation remains very solid, with €2,211m available cash (€566m in cash and marketable securities on the balance sheet, and €1,645m undrawn on a syndicated credit line). Debt maturities are well spread out, with a 2015 maturity of €490m (mainly treasury bills), a 2017 maturity of €494m (a five-year bond issued in 2012), and a 2019 maturity of €507m (a five-year bond issued in September 2014).

– The financial situation remains healthy, with gearing (net debt / equity) of 46% and a leverage ratio (net debt / recurring EBITDA) of 1.8x(8).

IV- GUIDANCE / DIVIDEND

2015 RECURRING EBIT OBJECTIVE

In 2015, recurring Group EBIT (Recurring EBIT from Media and other activities) is expected to increase by about +5% compared to 2014, at constant forex and excluding the impact of the potential disposal of LS distribution.

DIVIDEND

Shareholders at the Annual General Meeting will be asked to approve a €1.3 per share dividend for the 2014 fiscal year, the same level than for the 2013 fiscal year.

(1)Recurring operating income of fully consolidated companies in the four operating divisions. See definition at the end of the press release.

(2)At constant forex and excluding the impact of the divestment of Payot bookshops in Switzerland.

(3)Excluding non-recurring and non-operating items.

(4)At constant forex and excluding the potential divestment of LS distribution businesses.

(5)Objective stated on 10 February 2015 at the announcement of full-year 2014 net sales.

(6)At constant exchange rate and consolidation scope.

(7)See definition at the end of the press release.

(8)See definition at the end of the press release.

Agenda

• Annual General Meeting for the 2014 fiscal year

The Annual General Meeting of shareholders will be held on 5 May 2015 at 10 a.m. at the Carrousel du Louvre in Paris.

• Ordinary dividend

The ordinary dividend (proposed at €1.3 per share) for the 2014 fiscal year will be detached on 8 May 2015 and paid as of 12 May 2015.

• Release of sales for the first quarter of 2015

First-quarter sales will be reported on 12 May 2015 at 5:35 p.m. A conference call will be held at 5:45 p.m.

• Release of the first-half 2015 earnings

First-half results will be released on 30 July 2015 at 5:35 p.m. A conference call will be held at 5:45 p.m.

Reminder of definitions

Definition of recurring EBIT

Recurring operating income of fully consolidated companies is defined as the difference between income before interest and income tax expense and the following income statement items:

• contribution of associates;

• capital gains or losses on asset disposals;

• impairment losses on tangible and intangible fixed assets;

• restructuring costs;

• items related to business combinations:

– acquisition costs;

– gains and losses resulting from acquisition price adjustments and value adjustment incurred by changes in control;

– amortisation of acquisition-related intangible assets.

Definition of recurring EBITDA

Recurring EBITDA is defined as the sum of total recurring EBIT and depreciation of intangible and tangible assets and dividends received from associates

Media Contacts

Thierry Funck-Brentano - tel: +33 1 40 69 16 34 - tfb@lagardere.fr

Ramzi Khiroun - tel: +33 1 40 69 16 33 - rk@lagardere.fr

Anthony Mellor - tel: +33 1 40 69 18 02 - amellor@lagardere.fr

Lagardère is a world-class diversified media group (Book and e-Publishing; Travel Retail and Distribution; Press, Audiovisual, Digital and Advertising Sales Brokerage; Sports and Entertainment).

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Disclaimer:

Some of the statements contained in this document are not historical facts but rather are statements of future expectations and other forward-looking statements that are based on management's beliefs. These statements reflect such views and assumptions prevailing as of the date of the statements and involve known and unknown risks and uncertainties that could cause further results, performance or future events to differ materially from those expressed or implied in such statements.

Please refer to the most recent Reference Document (Document de reference) filed by Lagardère SCA with the French Financial Markets Authority (AMF) for additional information on such factors, risks and uncertainties. Lagardère SCA has no plans to update or review the forward-looking statements referred to above and is under no obligation to do so. Accordingly Lagardère SCA may not be held liable for any consequences arising from the use of any of the above statements.

Email alert

To receive institutional press releases from the Lagardère group, please complete the following fields:

Register