Press releases

Consolidated revenue, Q1 2016

Corporate & other activities, Finance

Paris, 12 May, 2016

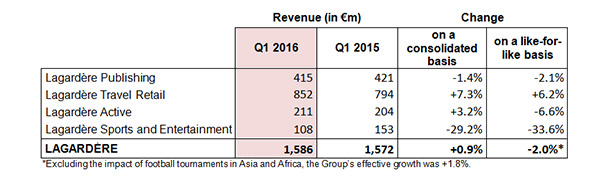

€1,586 million compared to €1,572 million in Q1 2015, i.e. growth of +0.9% on a consolidated basis, -2.0% like-for-like and +1.8% like-for-like excluding the calendar impact of sporting events

Lagardère confirms its target for recurring EBIT(1) for 2016

Arnaud Lagardère, General and Managing Partner of Lagardère SCA, said:

“As expected, 2016 started out with revenue up +0.9% on a consolidated basis.

During this first quarter, the implementation of our strategic plan led us to continue to reduce our involvement in Distribution and to forge ahead with the integration of the acquisitions of Paradies in the United States and Grupo Boomerang TV in Spain. We also moved to acquire complementary businesses in particular Rising Stars in the United Kingdom, akzio! ajoint and UFA Sports in Germany and, more recently, Perseus in the United States.

Based on this first quarter, we confirm the target for Group Recurring EBIT announced on March 9, while remaining vigilant, given the unstable geopolitical environment and the possible repercussions on our business activities.”

I. FIRST-QUARTER REVENUE

Group consolidated revenue in the first quarter of 2016 stood at €1,586 million, compared to €1,572 million for the same period in 2015, up 0.9% on a consolidated basis. Like-for-like, this growth came out to -2.0%, adjusted firstly for a -€10 million negative foreign exchange effect mainly due to the depreciation of the pound sterling, the Canadian dollar and the Australian dollar and, secondly, a positive scope effect of +€54 million, broken down as follows:

- Impact of disposals amounting to -€103 million, primarily relating to divesting from Press Distribution in Switzerland (Naville), the United States (Curtis), and Spain (SGEL) at Lagardère Travel Retail.

- External growth transactions amounting to +€157 million, primarily at Lagardère Travel Retail (consolidation of Paradies operations and stores at JFK airport in New York), at Lagardère Active (consolidation of Grupo Boomerang TV’s Audiovisual Production activities in Spain), Lagardère Publishing (consolidation of Rising Stars) and at Lagardère Sports and Entertainment (consolidation of UFA Sports, EKS and akzio! ajoint).

The impact of these transactions should be felt in the first quarter of 2016, in light of the seasonal impact associated with the schedules of football tournaments in Africa and Asia, with an impact of -€55 million in comparison to the first quarter of 2015. Restated for this effect, the Group’s effective growth was +1.8%.

II. REVENUE PER DIVISION

- Lagardère Publishing

A quarter that contracted slightly, as every year, but non representative of the trend for the year.

Revenue for the division totalled €415 million, down 1.4% on a consolidated basis and down 2.1% like-for-like. Relative to Q1 2015, data on a consolidated basis should be adjusted, firstly to reflect a negative foreign exchange effect (-€2 million) mainly linked to the depreciation of the pound sterling, and secondly take account of a positive scope effect (+€5 million), notably including the acquisition of Rising Stars in the UK in January 2015 (consolidated as of April 2015).

Just as in previous years, we emphasise that the first quarter traditionally makes a lower contribution to the year as a whole.

On a like-for-like basis, the main changes per geographic area are explained by the following:

In France, after a very busy Q4 2015, business performance was down slightly (-2.2%), as we expected, due to a General Literature release schedule that was lighter than in Q1 2015.

In the United States, activity contracted (-10.3%), due to a less intensive new General Literature release schedule than in Q1 2015, despite two major James Patterson releases, Private Paris and NYPD Red 4.

In the United Kingdom, activity was in decline (-5.2%), mainly owing to e-book sales, hurt by negative comparison effects stemming from the establishment of the agency contract with e-book distributors that took effect in July 2015.

The Spain/Latin America zone reported excellent business performance (+31.2%) thanks to a one-off export operation to Latin America.

Partworks experienced significant growth (+15%) attributable to the stunning success of launches in 2015.

E-books: the transition to digital still remains concentrated in the General Literature segment in English-speaking countries:

– In the United States, where the digital market is in contraction, e-book revenue made up 26% of total revenue for the division in Q1 2016.

– In the United Kingdom, where the market seems to be stabilising, revenue for digital stood at 20% of total revenue.

In Q1 2016, Digital accounted for 10.4% of total revenue for Lagardère Publishing (vs. 12.2% in Q1 2015).

- Lagardère Travel Retail

Continued growth momentum in Travel Retail

Revenue for the division totalled €852 million (+7.3% on a consolidated basis and +6.2% like-for-like) owing to a negative exchange rate effect this quarter of -€8 million, primarily linked to the depreciation of the Australian and Canadian dollars and a positive scope effect of +€23 million. The scope effect breaks down as follows:

- Disposal of Distribution activities in Switzerland (Naville) in February 2015, in the United States (Curtis) in June 2015 and in Spain (SGEL) in February 2016 with an impact of -€100 million.

- Acquisitions totalling +€123 million, mainly linked to the consolidation of Paradies’ US operations beginning in November 2015 and fashion and confectionery stores at JFK Airport (New York) beginning in April 2015.

The strategic transformation of the division is picking up speed. Travel Retail is growing and now represents 81% of revenue for the division, vs. 66% in the first quarter of 2015.

As such, on a like-for-like basis:

– The Travel Retail business is up 8.9%

Business is still being driven by growth in traffic, an improved product mix, the development of Duty Free and Foodservice, modernised sales outlets, and the roll-out of new concepts. This progression was achieved despite the progressive deterioration since late 2015, following the impact of the terrorist attacks in Paris and then Brussels on European tourism, the appreciation of the euro, the decline in spending by Chinese travellers and the slowdown in US growth.

In France, thanks to the expansion of the network, operations have returned to a growth track (+1.7%), despite the unfavourable business climate prevailing since the end of 2015 with the impact of the Paris terrorist attacks on tourism-related activities.

In Europe (excluding France), business is growing steadily (+13.0%) thanks in particular to the continued ramping-up of Italian operations (+8.0%, of which +9.3% in Rome) and the start-up of operations in Iceland and Luxembourg. The fast-paced growth in Poland (+30.3%) is being driven by the opening of new sales outlets. Romania also posted robust growth (+27.8%), due to network development and the rise in tobacco prices in the country.

Business recovered in the Czech Republic (+7.1%), despite the impact of the drop in Duty Free spending by Russian passengers.

In North America, revenue were up relative to Lagardère Travel Retail’s historic patterns (+3.1%) and were primarily driven by traffic growth.

The Asia-Pacific region also experienced a substantial increase in revenue (+17.5%), both in Asia, with the growth in fashion sales outlets in China, and in the Pacific region, with the launch of Duty Free operations in Auckland airport as of July 2015 following a successful request for proposal.

– Distribution down 2.2%

Business was specifically impacted by the interruption of Hungarian export activity in 2015 due to regulatory uncertainties.

- Lagardère Active

First-quarter performance was hampered by an unfavourable comparison effect, linked to the exceptional level of rights sales by Lagardère Studios during the first quarter of 2015.

Division revenue came in at €211 million (+3.2% on a consolidated basis and -6.6% like-for-like), marked by the level of rights sales in Q1 2016 lower than the exceptional level of Q1 2015 for Lagardère Studios. At the same time, solid performances by radio advertising, TV channels and digital revenue from Press websites are driving 2016 revenue.

The difference between consolidated and like-for-like revenue is mainly due to a positive scope effect of +€20 million, primarily associated with the acquisition of Grupo Boomerang TV (Audiovisual Production business in Spain) in May 2015.

The figures below are presented on a like-for-like basis.

The trend in advertising revenue for all media was stable at -1.3%. The first quarter has a relatively low impact on annual advertising revenue.

In light of the continued difficult situation in advertising (-11.2%), revenue at Magazine Publishing came out to (-5.2%), despite the good resilience of circulation (-1.1%) and growth of digital Press operations (+32.5%).

The Radio segment had a good quarter, with higher revenue in France (+4.5%), particularly in the music segment and international radios (+3.7%).

TV channels held steady (-0.6%) with a substantial increase in advertising revenue at Gulli (+5.2%).

As expected, Lagardère Studios posted a steep drop this quarter (- 27.3%), in light of an extremely packed first quarter of 2015 for sales of rights.

Excluding LeGuide.com which remains in decline (-23.7%), pure digital and B2B revenue rose +7.1%, primarily driven by diversification into e-health.

- Lagardère Sports and Entertainment

Growth of +5.1%, excluding the cyclical calendar effect associated with football tournaments schedules in Africa and Asia during the first quarter.

As anticipated, revenue declined, coming out at €108 million (down 29.2% on a consolidated basis and down 33.6% like-for-like). The difference between consolidated and like-for-like revenue is due to a positive scope effect of €6 million, primarily associated with small, targeted acquisitions during the second half of 2015. Stripping out the cyclical effect of football tournaments schedules, the division reported organic growth of (+5.1%).

As such, on a like-for-like basis, the change in Q1 2016 revenue is mostly due to an unfavourable sports events calendar associated with the organisation of two major football championships in Q1 2015, one in Africa (Orange Africa Cup of Nations) and the other in Asia (the AFC Asian Cup).

III. Key events since 1 January 2016

- Acquisition in Education in the United States

On 1 April 2016, Lagardère Publishing acquired the publishing business of Perseus Books, a US publishing group that releases 700 titles a year with a catalogue of over 6,000 titles. - Disposal of Distribution activities continued

– On 5 February 2016, Lagardère Travel Retail announced the signing of an agreement to sell its Belgian Distribution subsidiary to bpost group.

– On 26 February 2016, Lagardère Travel Retail completed the sale of its Spanish Distribution subsidiary, SGEL to Springwater Capital, a private investment fund. - Launch of a voluntary redundancy plan at Lagardère Active

- Bond issue

On 6 April 2016, Lagardère SCA successfully launched a €500 million, 7-year bond issue, with an annual coupon of 2.75%, for European investors. On the same day, Lagardère SCA repaid a bridge loan of $530 million, which it used to take over Paradies group in the United States (Lagardère Travel Retail) on 22 October 2015. - Extension of the €1.25 billion syndicated credit facility until 11 May 2021

On 26 April 2016, Lagardère SCA received the unanimous approval of thirteen banks to extend its €1.25 billion syndicated credit facility by one year. Following this extension, the facility will now fall due on 11 May 2021.

In 2017, Lagardère SCA will have the possibility to request another one-year extension. - Sale and disposal of an office building

On 29 April 2016, Lagardère sold to La Française REM a 20,000 sqm office building located in the 12th arrondissement of Paris which is currently being leased to third parties. - General Meeting

On 3 May 2016 at the Annual Ordinary and Extraordinary General Meeting, the shareholders approved all proposed resolutions.

IV. Financial position and Guidance

- Financial position

The Group’s financial position remains solid, with debt under control. The bond issue and the extension of the syndicated credit facility have enabled the Group to strengthen its liquidity position while benefiting from favourable market conditions. - Guidance

Lagardère confirms its target for Group Recurring EBIT announced on 9 March.

For 2016, Group Recurring EBIT growth is expected to be slightly above 10% compared to 2015, at constant exchange rates and excluding any impact from any disposal of Distribution activities.

(1)Recurring operating profit of fully consolidated companies (four operating divisions and other activities). See definition at the end of the press release.

Investor calendar

- Announcement of H1 2016 results

Half-year results will be released on 28 July 2016 at 5:35 p.m. A conference call will be held at 5:45 p.m. on the same day. - Announcement of Q3 2016 revenue

Third-quarter revenue will be released on 10 November 2016 at 8:00 a.m. A conference call will be held at 11:00 a.m. on the same day.

DEFINITION OF GROUP RECURRING EBIT

Recurring EBIT of fully consolidated companies is defined as the difference between income before interest and tax and the following items of the income statement:

- contribution of associates;

- gains or losses on disposals of assets;

- impairment losses on goodwill, property, plant and equipment and intangible assets;

- restructuring costs;

- items related to business combinations:

– expenses on acquisitions;

– gains and losses resulting from acquisition price adjustments and valuation adjustments related to changes in controlling interests;

– amortisation of acquisition-related intangible assets.

Press Contacts

Thierry FUNCK-BRENTANO - Tel: +33 1 40 69 16 34 - tfb@lagardere.fr

Ramzi KHIROUN - Tel: +33 1 40 69 16 33 - rk@lagardere.fr

Investor Relations Contact

Florence LONIS - Tel: +33 1 40 69 18 02 - flonis@lagardere.fr

The Lagardère group is a global leader in content publishing, production, broadcasting and distribution, whose powerful brands leverage its virtual and physical networks to attract and enjoy qualified audiences.

It is structured around four business lines: Books and e-Books; Travel Retail; Press, Audiovisual, Digital and Advertising Sales Brokerage; Sports and Entertainment.

Lagardère shares are listed on Euronext Paris.

www.lagardere.com

Email alert

To receive institutional press releases from the Lagardère group, please complete the following fields:

Register